On March 4th, Tuesday, the crypto market witnessed continued selling pressure as escalating trade tensions between the United States and China fueled market uncertainty. As a result, the Bitcoin price reverted below $85,000, accelerating the correction momentum in the majority of major altcoins like SOL. The falling Solana price is nearing a crucial support test, facing a risk of a $100 breakdown.

Key Highlights:

- Since March 2024, the Solana price has witnessed a high-accumulation trend at $120 support.

- A death crossover between the 50-and-200-day exponential moving average could bolster the SOL coin for a $120 breakdown.

- A major whale unstaked 79,530 SOL ($10.86M), signaling potential sell pressure.

Whale and Institutional Unstaking Triggers Selling Pressure on SOL

SOL, the native cryptocurrency of the Solana ecosystem, witnessed a notable correction from $179 to $137 — a 25% decrease — in the last 2 days. This downfall can be attributed to a broader market downturn and substantial unstaking of SOL coins from whales/institutions.

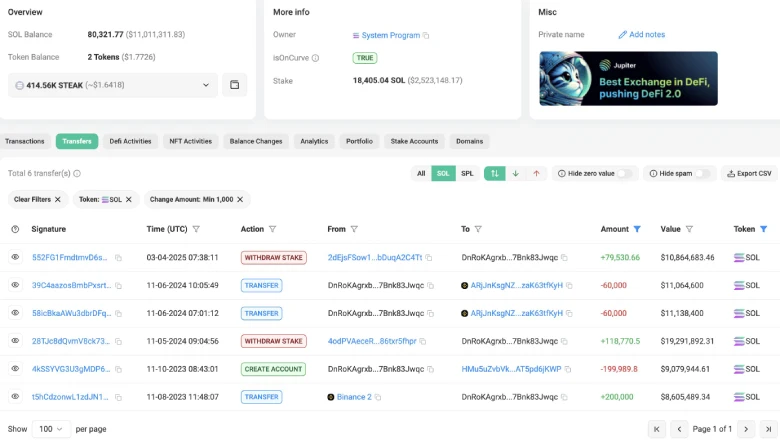

According to Lookonchain data, a crypto whale has unstaked 79,530 SOL, worth approximately $10.86 million, signaling potential selling pressure or repositioning in the market.

The whale originally withdrew 200,000 SOL ( worth approximately $8.6) from the Binance exchange on November 8, 2023, and staked it when the asset traded at around $43. On November 6th, 2024, the SOL holder unstaked and deposited 120K $SOL(22.2M) to Binance.

Despite the recent transaction, the whale still holds 98,727 SOL($13.53M), with a total profit of more than $27M

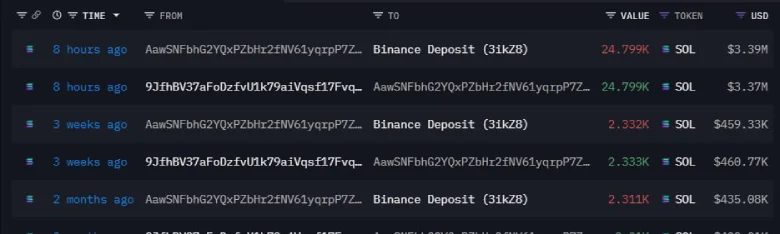

Meanwhile, institutional activity has also come into focus as FTX/Alameda unstaked a massive 3,030,000 SOL ($412.39 million). According to Solid Intel, part of this allocation—24,799 SOL ($3.37 million)—was deposited into Binance eight hours prior to the report.

These whale and institutional movements often add selling pressure to the market and raise bearish market sentiment.

Solana Price Nearing Major Breakdown

By press time, the Solana price trades at $136 with an intraday loss of 4%. The falling price is just 11% short of testing the multi-year support of $120. Historical data shows a reversal from this support has bolstered SOL price with a 60-120% rally, indicating a high accumulation zone.

Thus, the aforementioned level stands crucial for buyers to defend, as a bearish breakdown could trigger significant liquidation. A daily candle closing below $120 could accelerate a correction to $78 support, registering a potential loss of 35%.

If the sellers show sustainability below the $120 floor by mid-March, the SOL price could lose $100 mark by before month-end.

Also Read: Crypto Czar David Sacks Endorses Rollback of IRS Broker DeFi Rule