The ongoing correction trend in the crypto market saw a sudden rebound on March 2nd after U.S. President Donald Trump directed his Presidential Working Group on Crypto to move forward with the establishment of a Crypto Strategic Reserve. However, this news-based buying failed to sustain as major altcoins like ETH reverted immediately. The renewed downfall backed by whale selling is challenging a major support zone, raising concern for another breakdown.

Key Highlights:

- The ascending trendline as dynamic support drives the major uptrend in Ethereum price.

- A -9.5% daily candle, backed by low- volume, nearly evaporated ETH’s gain from Sunday’s market rebound, indicating intact selling pressure.

- Whale transfers 37,000 ETH ($86.94M) to Binance, triggering selling fears.

Ethereum Price Faces Breakdown Risk as Whales Dump Holdings

By the press time, the Ethereum price records a 9% intraday loss to reach a trading value of $2,289. The daily chart analysis shows the falling price is barely 5% short of initiating a breakdown below a key support trendline intact since June 2022.

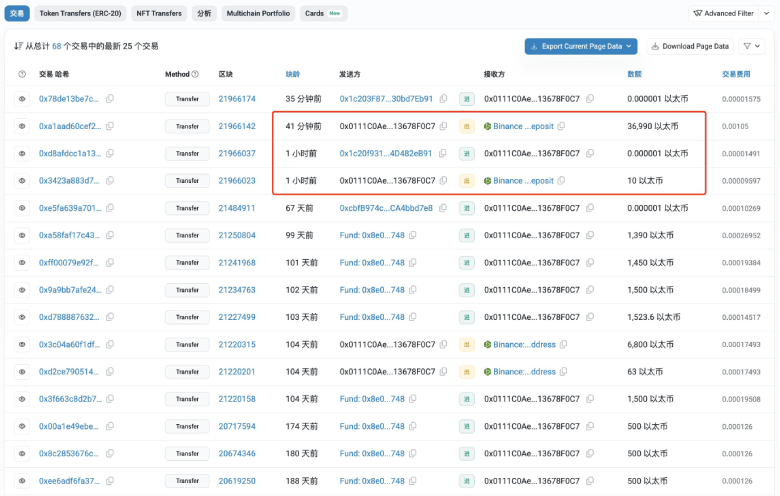

Amid the potential fall, a whale or institutional investor that had been accumulating Ethereum (ETH) since September 2022 has made a significant move, transferring 37,000 ETH ($86.94 million) to Binance before 40 minutes of reporting.

On-chain data reveals that this wallet has hoarded a total of 48,800 ETH over the past 18 months at an average acquisition price of $1,651. With ETH currently trading around $2,430, the investor has realized an estimated profit of $38.06 million on this trade.

Such large-scale transfer could accelerate the selling pressure on the Ethereum price and bolster it for another breakdown.

Key Support Zone Holds the Fate of ETH’s Uptrend

On March 2nd, the Ethereum price bounced from a long-coming ascending trendline with a morning star reversal pattern. Historical data shows this support trendline has acted as a major accumulation zone for buyers to drive a 120-160% rally.

While the recent upswing was backed by bullish sentiment surrounding Donald Trump’s announcement of a U.S. Crypto Strategic Reserve, Ethereum’s price action struggled to hold the $2,500 mark.

Thus, the coin price plunged drastically even with low-volume action, indicating weakness in buyers’ strength. If the ETH coin breaks below the bottom trendline, the selling pressure will accelerate the plunge of the assets to the $1,500 mark.

Therefore, the buyers must defend the ascending trendline to hold the prevailing uptrend.

Also Read: Strategy Holds 499,096 BTC, Makes No New Purchases last Week