The pioneer cryptocurrency, Bitcoin, witnessed a bullish turnaround with a two-day rally, registering a 2% jump to $97,100. While the uptick is yet to confirm a continuation of the prevailing uptrend, the reducing selling pressure from the long-term holders has stalled downside momentum. Is BTC price preparing for a $120k rally?

Key Highlights:

- The reduced spending behavior of Bitcoin long-term holders could lessen selling pressure in the crypto market.

- A triangle pattern breakout sets the coin for a 10% surge before hitting major resistance.

- The BTC price back above the daily exponential moving average (20, 50, 100, and 200) signals restoring bullish market sentiment.

Bitcoin Long-Term Holders Reduce Daily Spending by 60%

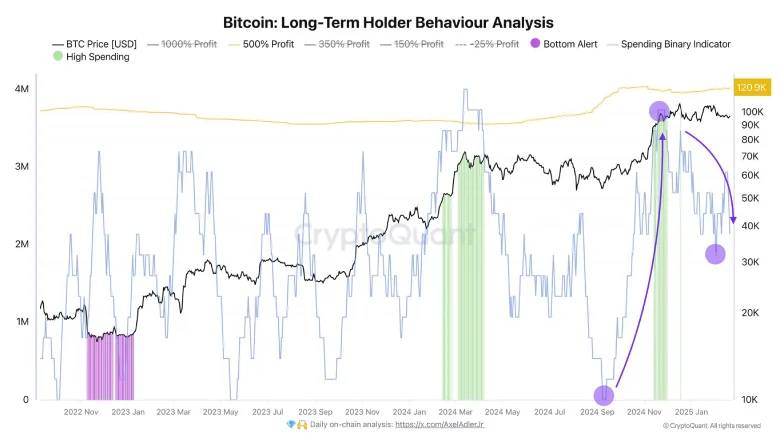

In a recent tweet, crypto analyst Axel Adler Jr highlights a notable shift in Bitcoin’s long-term holder behavior. According to the report, long-term holders have significantly cut down their daily spending, slashing it by 60% from the $90,000-$100,000 range to just 40,000 BTC per day.

This shift signals a strong conviction among investors, possibly anticipating higher price levels before offloading their holdings. According to on-chain data, a rally to $120,000 high could secure investors a staggering 500% profit, which could prompt them to book profit.

The historical trend shows the major top formation for Bitcoin price when the indicator reaches a high-spending area, which currently lies at $120k. Thus, the pullback in long-term holders selling could limit the downside potential for BTC.

Triangle Pattern Breakout Sets BTC For New High

Over the past three weeks, the Bitcoin price showcased a sluggish sideways trend resonating around the $95,000 level. This consolidation confined between two trendlines reveals the formation of a symmetrical triangle pattern.

Theoretically, the pattern drives a temporary consolidation before the asset price resumes with the prevailing market trend. With an intraday gain of 1.3%, the BTC price teases an upside breakout from the triangle pattern and reclaims the 20- and 50-day EMA slope.

If the breakout holds, the buyers could drive another 10% surge to challenge the multi-month resistance of $108,000. A successful flip of this overhead resistance is crucial for Bitcoin price to reach $120k high.

Also Read: Ex-ByBit Payroll Manager Jailed in $4.2M Crypto Theft Case