On February 18th, Tuesday, the Ethereum price recorded a 3.5% intraday loss to currently trading at $2,650. While the broader market uncertainty offers no help for recovery, the increasing traders bet on short-leverage positions, increasing the risk of a potential breakdown.

According to Coinglass data, the ETH coin currently holds a market capitalization of $319,2 Billion with a 24-hour trading volume of $24 Billion.

Key Highlights:

- A rising channel pattern in the 3d chart drives the current uptrend in the ETH coin.

- Record $11.3 Billion in Ethereum shorts highlights overwhelming bearish bets from traders.

- Analyst warns Ethereum price must hold $2,600 support to maintain broader market optimism.

Short Sellers Bet Big Against ETH as Ethereum Struggles Near Key Support

Amid the broader market uncertainty, the Ethereum coin has witnessed unprecedented bearish sentiment as traders stacked the largest short positions in history against this asset.

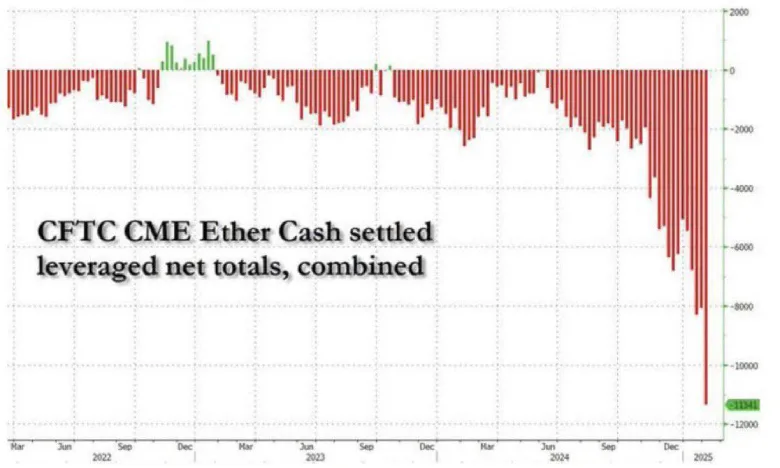

According to crypto analyst MartyParty, leveraged traders have built a staggering $11.3 billion in short positions on Ethereum (ETH). This marks a historic level of negative positioning on Ethereum, as reflected in CFTC CME Ether Cash settled leveraged net totals.

This indicates that market participants expect a major downturn in Ethereum price as it struggles to hold key support levels.

Ethereum Price Stands at Pivot Level of Major Breakdown

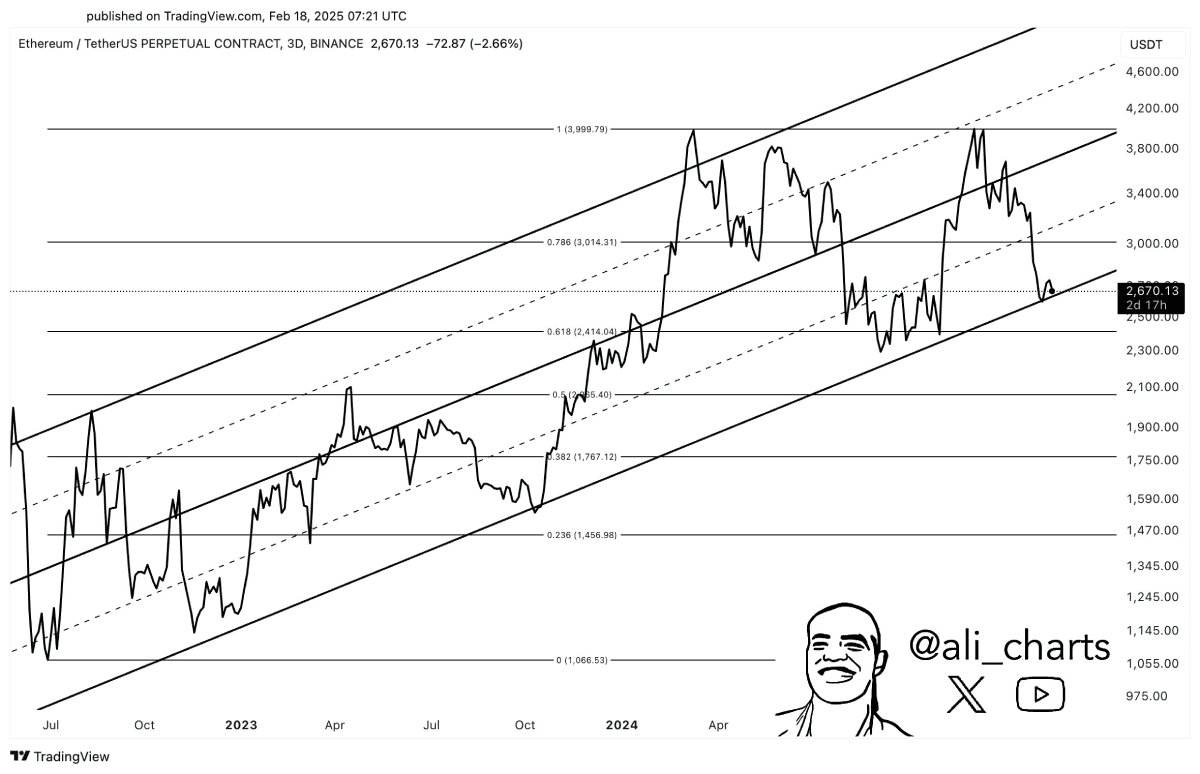

In a recent tweet, renowned crypto analyst Ali Martinez highlighted a critical situation in Ethereum’s price action. The 3D chart attached shows the ETH price resonating within the two rising trendlines of the channel pattern.

Since July 2023, the chart pattern has led to a steady uptrend, with its bottom trendline acting as a key accumulation zone for buyers. If history repeats, the recuperate bullish momentum at this support could trigger the next recovery leap for ETH price and chase a $5,000 high.

However, the current market sentiment accentuates the risk of a potential channel breakdown. A potential bearish crossover between the 100-and-200-day exponential moving average could accelerate the market selling pressure.

The analyst warns that this bearish breakdown could cancel the alt season and trigger a sharp ETH price correction to $2,000 or even $1,700.

Also Read: Institutional Investors Fuel Bitcoin ETF Growth, Q4 Holdings Surge to $38.7B