On February 13th, Thursday, the Bitcoin price showed a downtick of 1.7% to reach a trading value of $96,218. The selling pressure can be attributed to higher-than-expected U.S. PPI data, which suggests inflation remains sticky and near-term interest rates less likely. However, the BTC price could counter market uncertainty with whale accumulation, signaling the potential for a higher rally.

Key Highlights:

- Since mid-December 2024, the Bitcoin price has bounced several times from the $91,175 horizontal level, creating a strong pullback support for buyers.

- A flattish trend from 20-and-50-day exponential moving average signals at the near-term trend as sideways to neutral.

- Bitcoin whales seized the market dip as a buying opportunity, accumulating approximately $3.8 billion worth of BTC.

Bitcoin Whales Accumulate $3.8B Amid Market Correction

Over the past three weeks, the Bitcoin price showed a notable correction from $109,365 to the $96,399 level, projecting a loss of 11.88%. The falling price shows another bear swing within the three-month consolidation trend, indicating that buyers would need a longer time before a sustainable breakout.

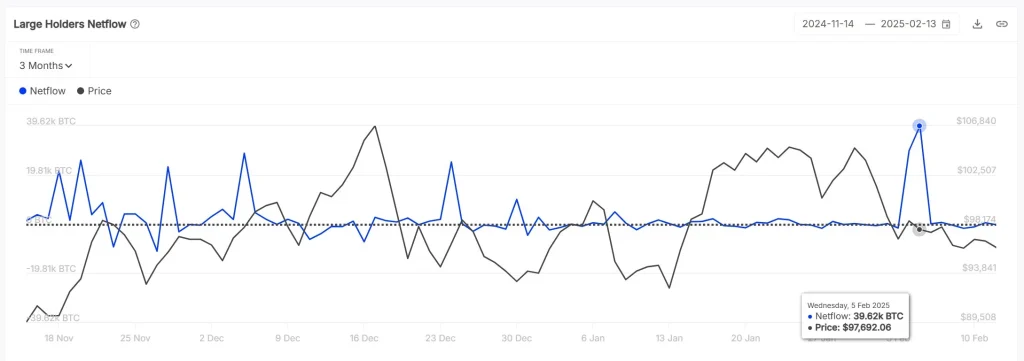

However, Bitcoin whales have accumulated nearly $3.8 billion in BTC during the recent market dip, according to on-chain data shared by crypto analytics firm IntoTheBlock.

A notable net inflow of approximately 40,000 BTC was recorded on February 5, marking one of the most substantial accumulation events in recent months.

Historically, such large-scale accumulation by whales has preceded bullish trends as institutional demand strengthens market sentiment and reduces sell-side liquidity.

Also Read: Apple CEO Applauds Deepseek, Nvidia Launches Deepseek R1 on NIM Platform

Bitcoin Price Face Key Support Test at $91,175 Floor

For over a week, the Bitcoin price has witnessed a low volatility consolidation around the $95,000 level. The lateral trend displays a series of neutral candles with long-wick rejections on either side as a signal for broader market uncertainty and no clear initiation from buyers or sellers.

However, if the market consolation persists, the coin price could plunge another 5.3% to seek support at $91,175. Historical data shows each retest to the bottom support has bolstered the BTC buyers to revive exhausted bullish momentum and drive a 12-20% recovery.

Thus, the market participants must watch the Bitcoin price behavior at $91,175 as a potential rebound could signal a surge to a new high while a breakdown will trigger a major downtrend.