Ethereum faces an 18% downside risk as whales and institutions offload large ETH holdings.

For over a week, the crypto market has experienced low volatility sideways trading, evidenced by Bitcoin consolidation around $95,500. While the market uncertainty has hindered growth potential in most major altcoins, the Ethereum price faces the risk of prolonged correction as initiations and Whale continue to sell this asset.

Key Highlights:

- The Ethereum price is 17.5% away from retesting the multi-month support trendline.

- A death crossover between the 50-and-200-day exponential moving average should accelerate the market selling pressure ‘

- The combined selling pressure from whales and institutions raises speculation of prolonged ETH price correction.

Whale & Institutional ETH Transfers Spark Market Fears

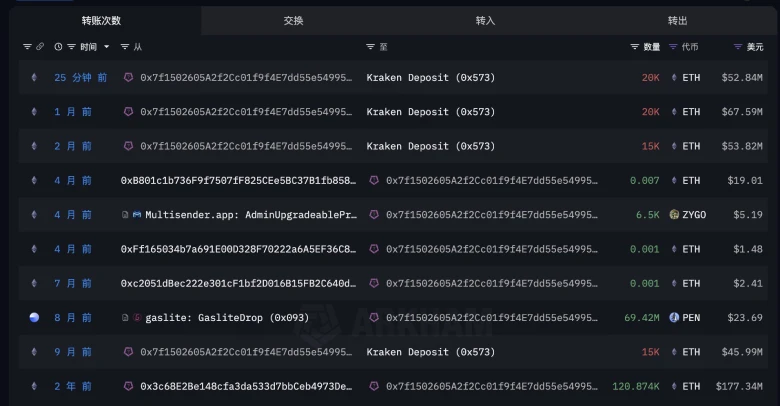

A prominent whale or institution that withdrew 120,874 ETH from Kraken at a price of $1,647 per ETH in September 2022 has resumed profit-taking. According to onchain data, the large holder has deposited 20,000 ETH (worth approximately $52.84 Million) to the crypto exchange Kraken just 25 minutes before reporting.

So far, this entity has offloaded 70,0000 ETH for $220.24 Million, securing $3,146 per ETH and realizing a profit of $104.9 million. Despite the recent sell-off, the whale still holds 50,874 ETH ($133.6M).

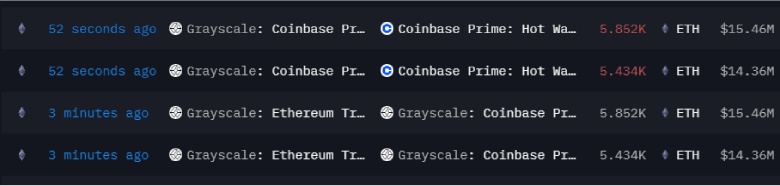

Meanwhile, asset management company Grayscale has initiated a large Ethereum coin transfer to Coinbase Prime, adding to market speculation of recent market selling.

On-chain data reveals that multiple transactions have occurred within minutes, involving 5.852K ETH ($15.46M) and 5.434K ETH ($14.36M) per transaction. Despite these transfers, Grayscale continues to hold 1.83 million ETH, valued at $4.88 billion

Historically, such whale/institution selling has promoted major market tops and prolonged market correction.

Also ReadL Apple CEO Applauds Deepseek, Nvidia Launches Deepseek R1 on NIM Platform

Ethereum Price Faces Critical Test at $2,150 After Bearish Breakdown

On February 4th, the Ethereum price breached the horizontal support level of $2,800. The bearish breakdown, backed by a substantial surge in training volume, accentuated the sellers’ conviction to drive a further downfall.

With sustained selling, the post-breakdown fall could plunge the asset 17% down to test the $2,150 floor — a level coinciding with a long-coming ascending trendline. Since last June 2022, this support trendline has maintained a steady uptrend in the daily chart, with each retest bolstering a surge in buying pressure.

If the support holds, the buyers could regain control over this asset and build bullish momentum for the next leap.

Conversely, a breakdown below the lower trendline will intensify the selling pressure for trend reversal.

ALso Read: