During Thursday’s U.S. market hours, the crypto market witnessed a slight downtick as pioneer digital asset Bitcoin plunged over 2%. This selling pressure has stalled the recovery momentum of top altcoins like Ethereum price and indicates the continuation of market consolidation. However, the latest on-chain data highlights the investors’ confidence in Ether’s long-term rally, suggesting a potential recovery in the near future.

Key Highlights:

- The majority of Ethereum (ETH) supply is held by long-term investors, with an average holding period of 2.4 years.

- A long-wick rejection candle at $3,300 hints at overhead supply that could prolong the current correction trend in the Ethereum price.

- The coin price holding above the 200-day exponential moving average indicates the broader market trend is bullish.

ETH’s Long-Term Strength vs. Short-Term Volatility

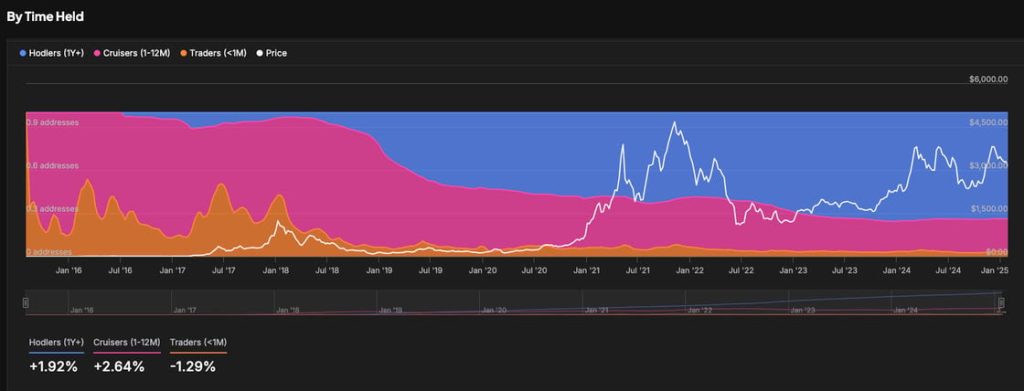

The latest on-chain insights from IntoTheBlock reveal the breakdown of the holder by time frame indicating that the majority of ETH supply is held by long-term holders rather than the short-term holding. With an average holding period of 2.4 years, these investors show confidence in ETH’s future potential.

However, the ETH’s short-term movement struggles to hold a sustained recovery due to the lack of short-term participants, the emergence of Layer 2 solutions, and alternative Layer 1’s.

This fragmentation in market attention could scare off speculative traders but may not affect the HODLers.

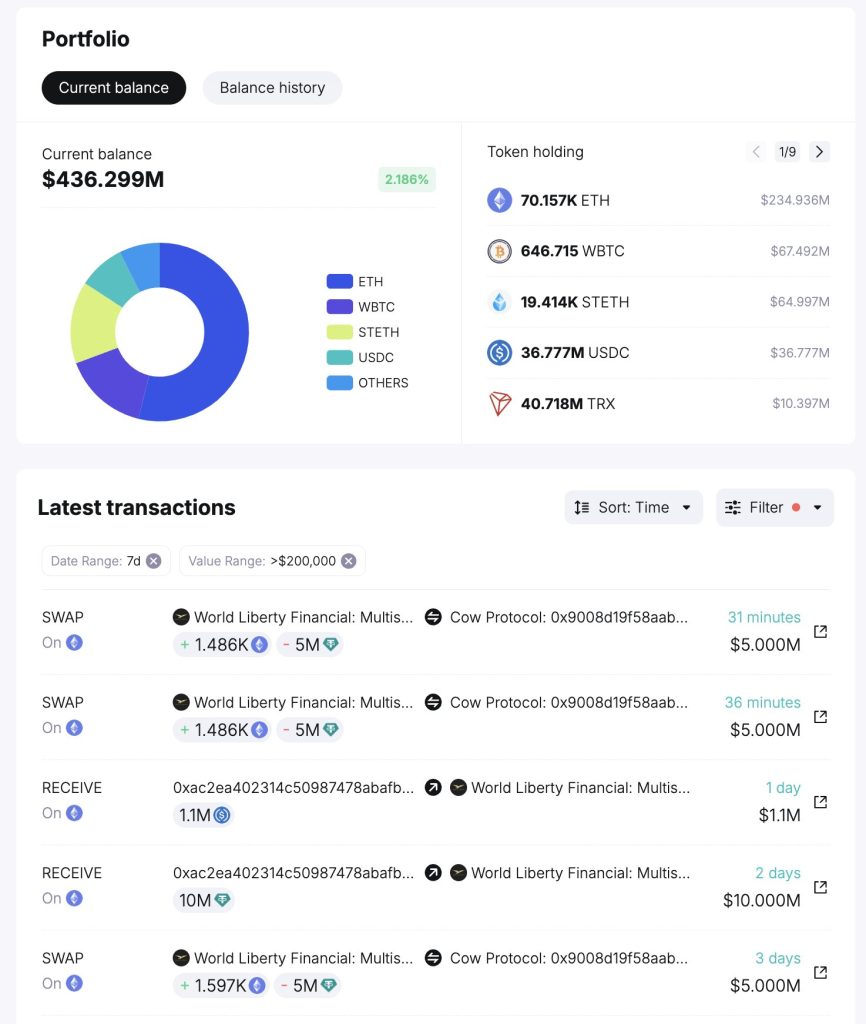

Another data from Spotonchain shows that Donald Trump’s DeFi project, World Liberty Financial, has made a substantial investment of 10 Million USCD to buy 2,972 ETH. This purchase raised their total holdings to 70,157 ETH ( worth around $235M).

Ethereum Price Eyes $4,000 as Falling Wedge Breakout Nears

In a three-day rally, the Ethereum price showed a notable upswing from $3,054 to $3,325, registering a growth of 9.1%. This recovery in the daily time frame chart teases a bullish breakout from a falling wedge— a pattern that drives a 2 months correction in ETH.

Theoretically, the pattern’s two converging trendlines indicate a diminishing bearish momentum, which bolsters buyers for a crucial breakout of the next recovery. If the ETH coin offers a daily candle closing above the downsloping trendline, the buyers could drive a high-momentum rally to the $4,000 peak.

However, if the breakdown fails, the coin price could prolong the current consolidation and potentially revisit the $2,800 level.

Also Read: Apple CEO Applauds Deepseek, Nvidia Launches Deepseek R1 on NIM Platform