According to Wu Blockchain, Matrixport, a leading digital asset financial services platform, has predicted that the price of the Bitcoin (BTC) token may surge to $160,000 by 2025. The main reasons for this significant surge include, growing demand of Bitcoin ETFs. favorable macroeconomic conditions and trends, and the expansion of global liquidity.

Bitcoin ETFs Gains Institutional Investor’s Interest

The report highlights the fact that the surge is mainly driven because of the increased institutional interest in the Bitcoin ETFs. These ETF’s provide a gateway for the institutional investors to BTC investment and adds credibility and accessibility to the cryptocurrency market. This system is expected to fuel adoption further and strengthen BTC’s market position.

Macroeconomic Conditions Play Significant Role

Macroeconomic conditions also play an important role in increased adoption of digital asset. With rise in inflation, Bitcoin’s appeal as a hedge against inflation increases. Additionally, the expansion of the global liquidity pool-boosted by monetary policies and technological advancements – provides a supportive environment for Bitcoin’s price appreciation.

Allocating Portfolio

The report also emphasized the importance of allocation in investment portfolios. The report also recommends a BTC allocation of 1.55%, noting that this ratio can deliver diversification benefits while preserving portfolio stability.

According to the Bitcoin price prediction by Matrixport, the value $160,000 for the B token could mark as another milestone in its journey as a transformative asset.

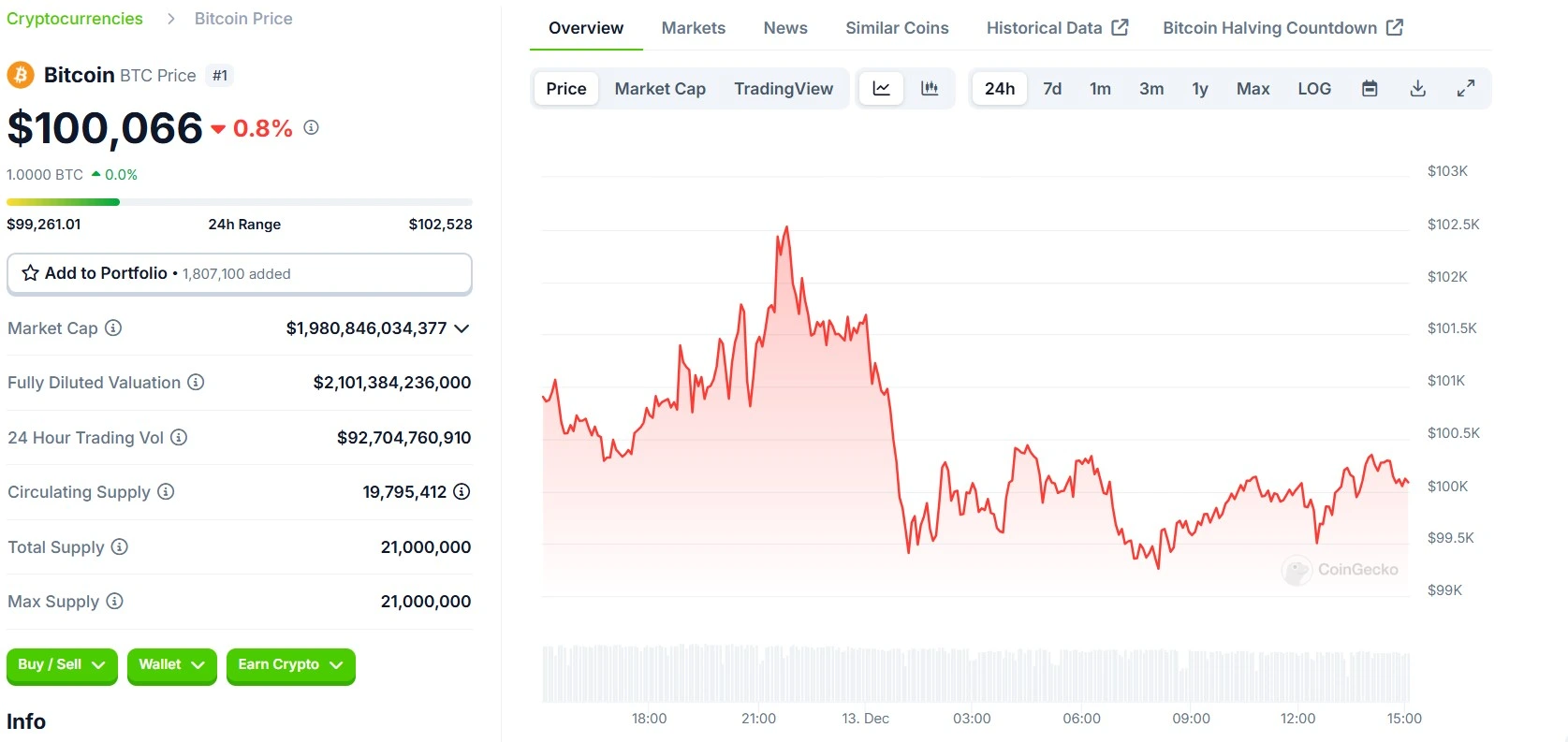

At press time, the price of the token stands at $100,06 with a dip of 0.8% in the last 24 hours.

Also Read: Polygon Community Proposes Unlocking Yield from $1.3B Stablecoin Reserves