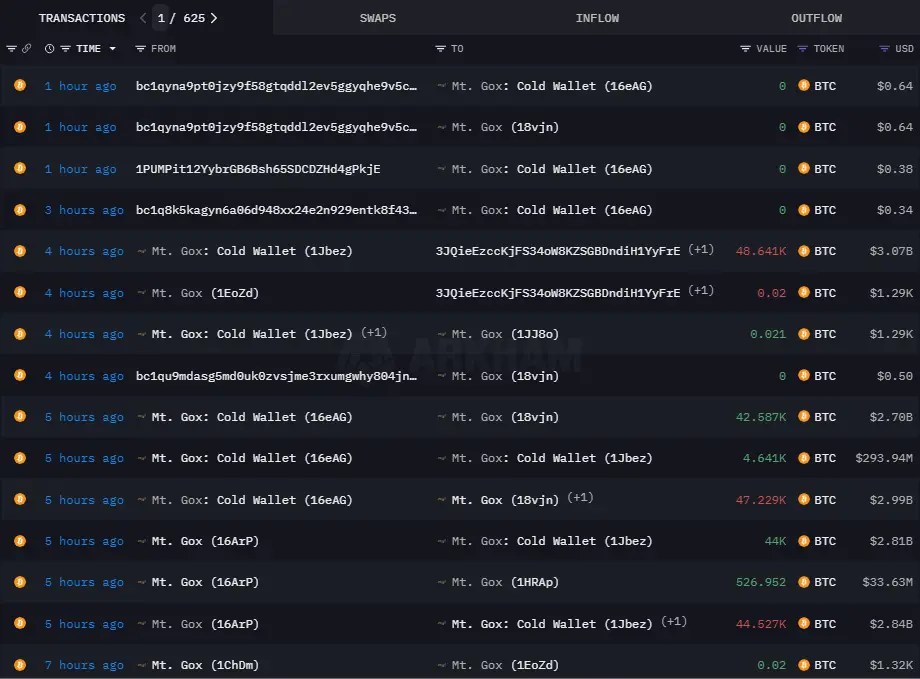

As reported by Arkham Intelligence, Mt. Gox wallets transferred a combined sum of 91,755 BTC—or $5.8 billion—to new addresses from the infamous exchange. The BTCs sent to new addresses are 48,641 BTC—$3.07 billion, 42,587 BTC—$2.7 billion, 527 BTC—$33.63 million, and 0.02 BTC—$1.3k.

The move highlights Mt. Gox’s continued management of the exchange’s extensive BTC portfolio, with the most significant chunk processed through several addresses. Many users reported receiving an email from the Kraken Exchange indicating that it has received creditor funds (BTC and BCH) released by the Mt. Gox trustee. Kraken has informed us that the funds will take 7-14 days to be deposited into the user’s account.

The move of 91,755 BTC from Mt. Gox wallets can have many consequences on the Bitcoin market as a whole. BTC, especially a large transfer from such an infamous source as Mt. Gox, will always raise questions and lead to speculation, which can result in short-term price fluctuations (downside volatility).

Liquidating a large portion of this BTC could increase the market supply, possibly leading to temporary price reductions. This could affect the positions of trade and investors, which may increase trading volume and price swings. In general, however, the markets watch closely for such large movements, which can have significant short-term implications.

The Big Picture: Bullish on Bitcoin

The development is further layered by the fact that BlackRock is also backing another major spot, Bitcoin ETF—IBIT—and has 240k BTC, which is just under three dozen times more than MicroStrategy. A meeting with key parties involved in the Mt. Gox scandal could rapidly change those dynamics thanks to large BTC movements from wallets of both exchanges and BlackRock’s sizeable holdings, which have likely been undisclosed until now.

BlackRock has enough that it likely provides a floor in the market, but all those BTC from Mt. Gox suddenly moving might keep things interesting for some time. Any of these Bitcoins moved this week might be sold, which could create brief supply-side pressure on the price. Alternatively, BlackRock’s significant and stable holding combined with its massive institutional interest may mitigate some of this effect by supplying a bumper for Bitcoin prices.