A soon-to-come rate cut from the Federal Reserve in September is set to have huge implications for the cryptocurrency market. The global bond and equity markets have already taken some clues from the Fed as key indices like Nasdaq, Nifty, etc, rallied to all-time highs in anticipation of a rate cut. The emotion is likely to carry over into the crypto space, too. While the US and other global stock markets fight with selling pressure, coupled with a wave of bad reviews on economic data across the globe, speculations are intensifying about an aggressive preemptive easing stance by the U.S. Fed.

Are Fed Rate Cuts In Motion?

Data from the U.S. Labor Department recently showed that just 114,000 jobs were created in July, not many more than most had expected. Meanwhile, the unemployment rate rose to 4.3 percent from June’s incredible low of only 4.1 percent. This has forced the market to almost fully price rate reductions of 50 basis points, diverging from earlier expectations for just a quarter-point cut at its September 17-18 policy meeting.

The central bank’s response to such economic signals has given rise to a debate on whether or not the Fed is way behind in modulating its policy, keeping ahead of an impending recessional environment. Many expect it to take a more aggressive stance against a slowing economy. Investors were beginning to wager that the Federal Reserve would get on course for an aggressive interest rate cut already at its September meeting, and further weakness in data will likely reinforce those views.

“If Powell knew then what he knows now, he probably would have cut rates. By keeping rates on hold while inflation fell, they’ve applied too much pressure on the brakes,” Brian Jacobsen, Chief Economist at Annex Wealth Management, told Reuters.

Is a Crypto Market Boom on its way?

The ripple effects of the central bank signaling a transition to an expansionary monetary policy are likely to be felt across different financial sectors, including crypto.

Riskier Asset Class Allocations Rising

In general, the cost of capital for corporations and consumers is lower when interest rates are low. However, the ECF and BDF situation promotes investment in higher-risk assets such as cryptocurrencies (primarily by individual investors) because they want more profitable investments to compensate for traditional investments like bonds. If bond yields fall below 4%, this could propel the appeal of crypto assets – typically offering higher return potential. Apurva Sheth of SAMCO Securities points out that the fall in U.S. 10-year bond yields (inversely related to bond prices) has supported emerging markets and metals as it should lead money back into riskier assets. This favorability will already ripple over to the crypto market, increasing digital asset demand.

Impact on Bitcoin and Ethereum

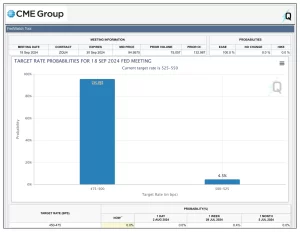

Being coined “digital gold”, one may encounter similar market phenomena supporting commodities like gold and silver during rate reductions. If capital costs drop and inflation expectations rise, investors could look more towards Bitcoin(and other cryptos) as a hedge against inflation or currency debasement. This perception is further cemented by the fact that the CME FedWatch tool now suggests an absolute certainty of a rate cut in September, giving investors looking to diversify away from traditional assets and lean more towards cryptocurrencies.

Keeping current rates steady but hinting at upcoming cuts means the Fed wants to avoid tipping people into a recession. This tactic will likely be reassuring among investors, bringing about a more positive sentiment overall for cryptocurrencies. Interest rate stability or dropping interest rates can lower borrowing costs and boost market liquidity, which is good news for broader investment in digital assets.

That being said, crypto prices could experience some pressure should stocks drop due to the market repackaging in rate cut anticipations. When stocks are cheaper, the wealth effect for investors becomes negative, and both disposable income and speculative spending in cryptocurrencies are lower. With the stock market’s sentiment dampened on August 5th, the crypto market has also been hit hard. On August 5th, the crypto market saw major liquidations as per Coinglass data, where Bitcoin saw $347 million, and Ethereum saw $340 million depleted due to liquidations throughout the last 24 hours.

Yield, Borrow Rate, and Collateral Value May Be in Crypto Market’s Favor

With rate cuts on the horizon, lower borrowing rates may also result in a friendly crypto market. Because stocks are often used as collateral for loans, this can make it challenging to be accurate in calling when the record losses may lead to margin calls and forced selling, causing credit conditions to be tighter. In these crises, the search for capital growth on behalf of investors often leans towards crypto assets that still have untapped potential. Cryptocurrencies may also use DeFi platforms as collateral, which look more attractive than traditional borrowing costs.

Ultimately, an expected rate cut on the part of the Federal Reserve stands to create a risk-on environment that should benefit cryptocurrencies through their appeal as both investment and alternative stores of value alike, especially as the U.S. political landscape has been so welcoming of cryptos. However, the current challenge for crypto is overcoming the increasing market volatility and course-correcting its prices. With a total amount of $1.029 billion in liquidations, investors are reconfiguring their portfolios to take advantage of the slight market fluctuation. The relationship between these entities implies that the crypto market will be volatile (for a while) in response to the traditional financial setup. Further, major indicators such as employment rates, inflation, and consumer confidence will also determine the tangent of the crypto market. Any major volatility is mostly temporary, but such breaks in enthusiasm can keep down certain types of asset classes, potentially including crypto at times too, and might experience mixed performance during those periods (to a degree).