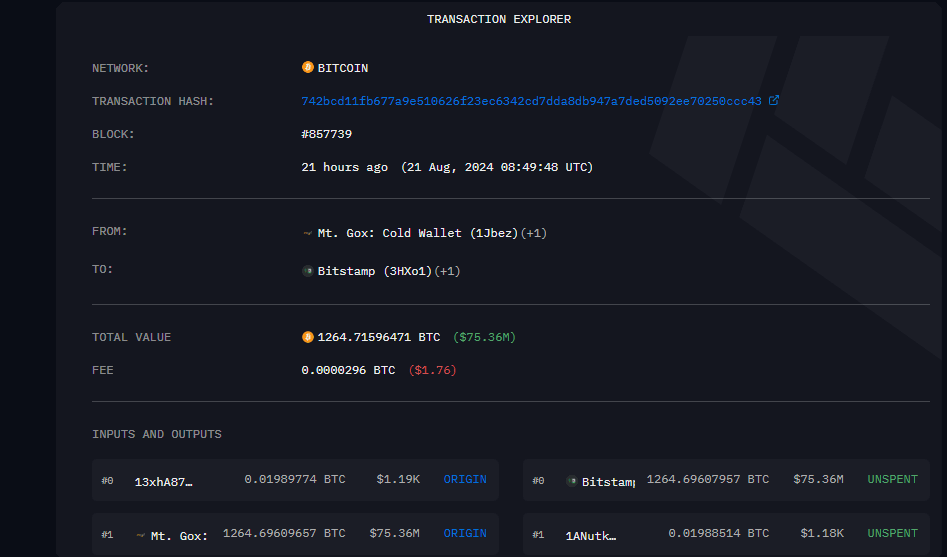

According to Arkham Intelligence, Mt. Gox moved 1,264.7 BTC to the cryptocurrency exchange Bitstamp earlier today at around 16:49 UTC+8 (worth about $75.36 million). The spotlight is once again on the now-defunct exchange following this movement, and blockchain data provider Arkham has confirmed that there was such an outflow. After this transfer, Mt. Gox still has an ample 34,164 bitcoins worth $2.03 billion in its possession — which seems like an unreasonably high figure for the defunct platform to have left standing around post-bankruptcy filing.

This news also adds to growing speculation over the pending repayments of Mt Gox creditors, who have now waited for almost a decade simply in order to receive funding back.

Ongoing Repayments

The last of these transfers had come just days after Mt Gox said it had sent 12,000 BTC — $709.44 million worth—to an unknown wallet. Arkham, which also monitored this transaction according to Coinmetrics data, happened at 11:39 p.m. UTC on Tuesday. Mt. Gox also had 1,264.69 BTC ($74 million) moved to a cold wallet at the same time. Interestingly, these large sums have not yet been broken down into smaller, stirring rumors that the actions are perhaps preparing for upcoming claims of Bitstamp and Kraken on final reimbursements to the exchange’s creditors.

Mt. Gox: A Decade-Long Saga

Mt. Gox, one of the first and, at its peak, largest bitcoin exchanges in the world, was hacked in 2014, leading to a loss of at least 850000 BTC. The collapse of the exchange has also left thousands of creditors wondering when they will get their funds back.

A Precursor to Final Repayments

Mt. Gox made its first reimbursement on July 5, disbursing $148 million in Bitcoin to creditors, a mere trifle that makes up only about one-tenth of the total claim of $8.2 billion (141379 BTC atrocities). This first payment was substantial, but it only made a dent in the accurate total owed, and fears quickly spread about what effect this might have in the broader cryptocurrency space. This may exert intense selling pressure should the current market decline persist.

On Reddit, discussions among the fallen victims paint a bittersweet picture, with many claiming they received only 0.15 BTC per every original 1 BTC from back in 2014. This is a step up—in the right direction—but also a stark acknowledgment of what has been lost and how many had trouble generating receipts for their holdings during the bearish 2015 months. The market will be watching closely the potential consequences of these giant distributions as people continue to repay them.