Introduction:

eToro is a popular social trading service providing company. It has its registered offices in London, Limassol, Tel Aviv-Yafo. The company was established in 2007. It was founded as RetailFX, and later it released a Social trading platform with copy trading features in 2010. A couple of years ago, eToro and CoinDash joined hands to develop Blockchain-based social trading. It is undoubtedly a well-known fintech startup, and people don’t mind trusting; it is supported by financial authorities too.

eToro allows investors to trade and invest in top stocks, ETFs, & CFDs and almost anything like indexes, commodities, etc. through mobile or web. CFDs with this provider are considered to be complex trading instruments where the inventor stands at a high risk of losing money. So, consider this option only when you can afford it.

Let us know more about eToro through the following questions:

Can traders make money on eToro?

No matter which trading platform you are using, or which instrument you are investing in, the sole motto of you has to be making money. eToro has a social trading platform that helps investors in shaping their trading skills. People share their strategies on this social trading platform. All you have to do is open an account and find out who is the top or trending traders on social trading and follow their strategies.

When in doubt, investors can leverage the presence of eToro platformTrading Academy where live webinars are conducted. The platform also has other tools to help investors understand the process well before investing. ETFs or CFDs, you will be able to make choices on your own once you understand the market and your investment capabilities.

Another way of earning from the eToro platform is through the monthly fee. It has a system with four levels, namely Cadet, Rising Star, Champion, and Elite. Investors can earn at every level depending upon how many copiers are attached to the profile connected and how many traders they bring to the platform.

Once Traders reach the ‘Elite’ level, they have a chance to receive 2% on every investor account they manage or a fixed monthly income of $1000. Elites do not have to pay any commission on the trades they make. They also get a 100% rebate on the net spread; hence traders can bring in more money in the trading. One more way of earning money via the eToro platform is to refer the platform to friends. One can refer to as many as 10 friends. To get benefited from this program, each friend has to open an account and deposit a minimum of $500. If so, a trader will earn $20 for each friend. So the chances of earning money using the eToro platform are high.

Is eToro good for beginners?

Losing your money is always set back whether you are a beginner or an expert. However, if you are a beginner, you most probably will not take practically and might lose interest or courage to learn and trade. Hence, it is important to invest in the instruments you are aware of through a reliable platform. The eToro platform is considered reliable by many people across the globe based on the support lent by credible financial organizations to the platform.

The eToro platform allows you to invest in two ways.

- Buying cryptos with no leverage: Where you own the asset that is securely held in cold storage by eToro on your behalf.

- Invest in cryptos using leverage via trading CFDs: Traders will not own the asset. Traders will be earning through speculations – whether the asset’s price will increase or fall. However, trading CFDs is subject to higher risk. 66% of retail investor accounts lose money while trading CFDs with eToro. If you are able to afford the risk, then only you can go ahead.

As a short eToro review for beginners would be:

The eToro platform is undoubtedly one of the popular cryptocurrency trading platforms on the market (which offers social trading). Trading is user-friendly, and the platform provides retail investor accounts with all the features professional traders would require. A retail investor can diversify the investment portfolio to leverage the most from the cryptocurrency market.

Should I invest in eToro?

The eToro platform is both a trading platform and a copy trading platform. This means a retail investor can use the platform to trade stocks, commodities, forex or cryptocurrency, etc. But retail investor accounts can make money through copy trading, where investors can copy what the most experienced traders on the platforms are doing. There are no fees for copy trading. If you are a beginner, copy trading reduces the risk of losing money.

If you’re a pro retail investor, then the eToro platform could be a great choice for you as a second source of income. The more other retail account holders copy your trade, the more money you make. For this to work, you have to be a good trader, and other investor accounts are not going to copy you, take the high risk, and fail or if you are losing your money consistently.

Other investors are following you as they do not wish to take the risk of losing money. So, your profile has to be reliable for them. If so, then only you both stand a chance to earn money trading. Overall, eToro is a good platform for both new traders and pro traders.

Is eToro good for traders for long-term investment?

Here is an eToro review any investor account would need to know before it makes a long-term investment using the platform.

If you wish to make your money when trading CFDs or stocks for the long term, you have to be assured of the platform and its credibility. Trading anyway involves high risk, and one may lose money. As we can understand, losing money will not really motivate you to continue trading. Let us know a few things about the eToro platform, and then you can consider whether you wish to invest here for the long term or otherwise!

eToro UK Pvt Ltd. & eToro Europe facilitates zero-commission stock trading in Europe. Investors can open trading accounts easily and seamlessly. The platform also allows social trading and copy trading (something that can be used to tackle high risk and avoid losing money when trading CFDs). Though it only allows USD transactions, overall, it comes in handy due to cheap stock trading.

As we have seen above, the platform allows both trading stocks and crypto-assets & trading CFDs. Depending upon whether you can afford to take a high risk or otherwise, you can make the choices.

As far as credibility is concerned, here is something that might assure of eToro and help you form an opinion:

eToro is governed by trusted financial authorities from Australia, Cyprus & the UK.

- eToro Europe Ltd. – regulated by CYSEC.

- eToro UK Ltd – UK – regulated by the UK’s FCA (Financial Conduct Authority).

- eToro AUS Capital Pty Ltd – regulated by ASIC (Australian Securities and Investments Commission).

The platform is user-friendly and provides multiple sources of income via social trading, copy trading, and trading. In short, one can consider eToro for long-term investments.

Pros and cons after eToro Reviews:

Pros

- Free stock and ETF trading in the EU

- Seamless account opening

- Social trading experience

- low fees for non-EU clients.

Cons

- High forex fees

- Withdrawing money is slow and expensive

- Only one account base currency

Why Choose eToro?

How do I withdraw money from e Toro?

Retail Investors will have to place a request to withdraw money from the account. Investors have to follow the below-given steps:

- Click on the Withdraw Funds on your left-hand side of the eToro website.

- Enter the amount you wish to withdraw (As the eToro platform deals in one currency, USD, the amount has to be mentioned in the same currency).

- Fill the electronic withdrawal form as required.

- & Submit.

Before you place a withdrawal request, make sure you have enough funds in the account. In case you have invested money in open positions, you can close those positions and free up your money. Once the position is closed, the invested funds (after adding profit or deducting losses you have incurred) will be transferred to your bank account attached to the eToro.

Make sure of the following:

- You have a verified account.

- The minimum amount of money you can withdraw is $50.

- The withdrawal fee is $5.

- You will receive an email notification once your withdrawal request is processed. It usually takes up to one business day.

- You can cancel the withdrawal anytime during the “Under Review” status.

- The estimated period to receive the payment will depend on the payment provider.

Is eToro trustworthy?

There are a few platforms in the market which have turned out to be scams. So, it is understandable if we doubt the credibility of each platform and gather as much information as possible before using it for trading. So, here are eToro reviews on whether the platform is trustworthy or not?

Although the eToro platform is dedicated to cryptocurrency trading, it is a useful platform as it facilitates trading in other multiple instruments like indexes, commodities, trading CFDs, etc. The platform has unique features like copy trading (to ease the trading process for beginners), & social trading. The platform is highly responsive and user friendly. It is an excellent trading platform for those who wish to trade in major cryptocurrencies and want to indulge in both fiat and crypto trades at the same time.

Deposit and withdrawals are processed quickly, and this adds to the credibility. As far as the trustworthiness of the platform is concerned, it is positive and backed by a few reputed financial authorities in the world, such as Cyprus Securities & Exchange Commission (CYSEC). eToro is compliant with European Securities and Markets Authority rules. The platform allows phone-based two-level authentication and standard SSL. Fee disclosures are transparent and clear to understand.

What is the minimum deposit for eToro?

The minimum deposit means that you will first need to transfer this amount to your brokerage account from your bank account in order to start trading. It is sometimes called an initial deposit or funding.

Beyond the required minimum deposit, there are a couple of other factors to consider when you are about to open an account at eToro.

Why does eToro require a minimum deposit?

Online brokers often demand a minimum amount as a deposit to support their initial costs of creating a new investor account and for the sake of profitability of the platform.

Each broker has a base currency, which means it saves the deposited money in that currency. eToro supports the only USD. This means, if you send your deposit money in any other currency, eToro will convert it into USD and charge a currency conversion fee. You should not have to bother if you are depositing in USD. Open a multi-currency bank account to avoid such fees.

Account opening and depositing money take no more than a few minutes.

- Open your broker account

- Make the deposit through either bank (wire), credit/debit card, or online payment wallets.

- The platform reviews your transaction.

What exactly is CopyTrader?

CopyTrader is a game-changing idea deployed by eToro where anyone with the account on the platform can trade like top trades simply by copying their strategies. The platform does not charge any fees for this. The traders you copy get paid directly under the ‘Popular Investor Program.’ Once people start copying your portfolio, you get paid too. Those who do not want to face a high risk of losing money due to a lack of market knowledge go for this option. You need to understand your position, eligibility in terms of investment and market know-how, and then consider whether to go with the option of copy trader or otherwise.

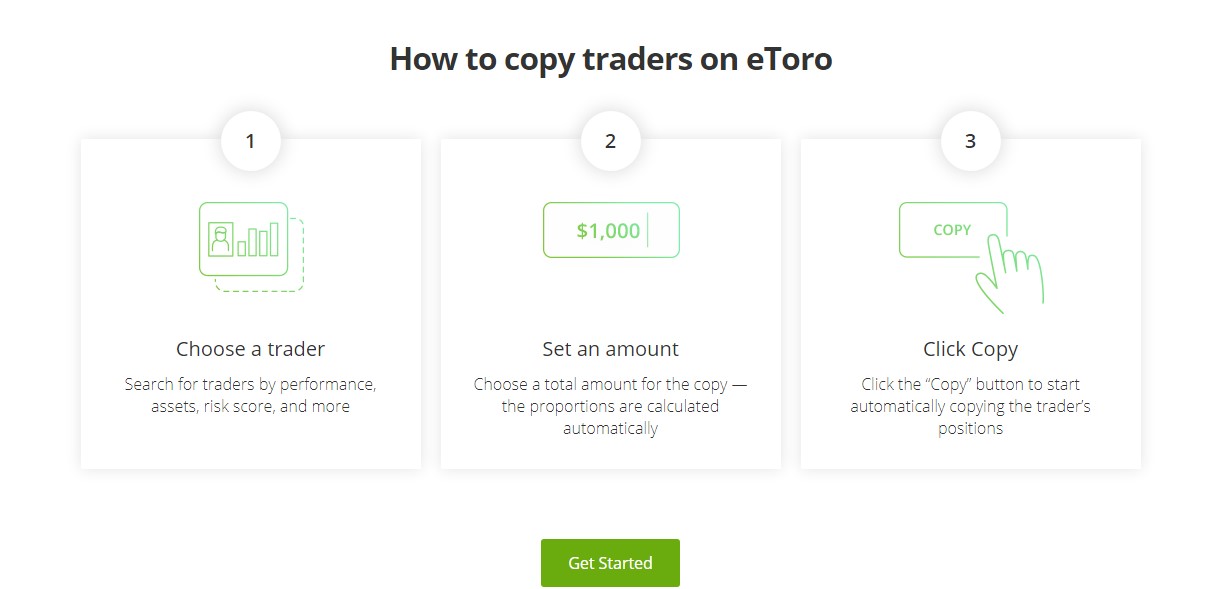

All you have to do is:

- Choose a trader from the vast eToro community. Choose based on their performance, assets, and more. Consider whether you are up for a trader with great success but a more risky portfolio or the one who plays it neutral or with the passive trader.

- Set an amount for the copy & click on ‘Copy’. The trader’s exact portfolio will get copied in your portfolio.

How to become a top trader on eToro?

To become a top trader on the eToro social trading platform, traders will have to join the Popular Investor Program. Simply open an eToro trading account and start trading. You can trade CFDs; you can trade stocks and other instruments. As you start trading, somebody starts copying you once your progress looks good. And this is how it starts.

Depending upon your trading progress, the platform awards you with badges for each level. Cadet, Rising Star, Champion, and Elite.

- Cadet Traders:You have to have at least one copier.

- Rising Star Traders:When you have at least 50 copiers.

Here, you start getting a fixed payment of $350 each month, along with the benefits of the Cadet level.

- Champion Traders:Once you have a minimum of 250 copiers.

Fixed monthly payment becomes $1,000 and many other benefits like share in revenue, etc.

- Elite Traders:

You have at least $300,000 worth of copiers’ funds copying you. You can see all the benefits on the eToro official platform. Here, there is no limit on how much money you’ll make.

There are a few terms and conditions for this, here are a few of them:

- eToro does not accept trading from users from a few countries like the USA, Japan, Brazil, Canada, North Korea, Iran, and Turkey. These users cannot be a part of the Popular Investor program.

- Traders of this program must submit and use the real picture of themselves for profiles. eToro customer service will be verifying the details of the traders.

- Their account has to be active on the platform, and the profile shall remain public all the time (visible to all on the platform).

As a part of the eToro review, let us know more about a few critical factors of trading.

- Account Verification:Gibraltar’s regulatory instructions ensure that each new account/profile can be accepted only after proper verification. As a part of this process, the registration on eToro is made as simple as possible on the platform.The platform takes up to two business days to verify the account after submission of all the required data and documents. A user has to submit documents supporting their identity, nationality, and other demographic details.The eToro platform asks forth the following documents:

- Proof of Identity (POI)An authorized document is having your name, DOB, a clear photo, issue & expiry date of the document. For example, passport or driving license.

- Proof of Identity and Selfie (POIS)Here, you take a selfie with a POI in your hand. You and the proof bot should be visible clearly.

- Proof of Address (POA)It is a document with your full name, address along with other details. For example, Bank Statement, Utility Bills, Tax-related documents, etc.

- Commissions & FeeseToro is a comparatively expensive platform. Compared to other platforms with fixed & floating spread, eToro lists a common minimum fixed spread of three pips on the EUR/USD, which is high.If we are talking about fees, retail traders do not prefer eToro for its spreads. However, they love it for social trading tools.

- VIP accounts: The platform offers a VIP club membership to the traders. It has five levels of membership, from gold to diamond. VIP membership is available for traders who consistently maintain account balances between $5k -$250k. Depending upon at which level the trader is, the benefits vary. One might get a dedicated account manager, or a discounted withdrawal, etc.

- Account tiers: eToro’s Popular Investor program has four levels – cadet to elite – where a trader can receive a range of benefits from spread rebates to a fixed monthly payment more. This program motivates people to perform better and maintain a positive portfolio. The focus is on reaching successful results and earning extra rewards in return.

- Customer ServiceThe contact page of the official eToro site shows 24/5 customer service. However, one cannot reach the support team via phone calls. Only those who have grievances or doubts about getting cleared from the Australian branch will be able to connect through calls.For others, there is a Help Center link in the drop-down of the ‘company’ tab, which leads to an FAQ page and ‘help’ database; one has to search for the issue in the database & follow the guidelines mentioned there. There is an option of live online chat for existing traders. eToro is also active on its Twitter and Facebook accounts, which are used more for marketing and analysis entries, than customer service.

- Investment ProductsThe product catalogue of eToro has 47 currency pairs and 19 commodity/index CFDs apart from 77 cryptocurrency CFDs and over 1500 shares. All these investment instruments are open for the trade, but users better go through fine print as each venue and order type goes through the changes overnight. Although eToro runs an aggressive program to avoid disputes, it acts as a counterparty.

- Review & Reputation of eToroeToro users and reviewers of the platform typically agree on the ease and the user-friendly framework of the application. It runs equally smooth on mobile and web. The design is interactive, simple, intuitive. No matter which computer or mobile device you use to operate the account, the platform will treat you well.

Even a new trader would easily understand what to do and where to find the information on the website in case of any doubts. Even trading and account verification processes are faster.

In general, eToro holds a good reputation in the market. It is widely being used by online traders. Due to the fast withdrawal and deposit of the funds, it becomes even easier to trust the platform. Sometimes traders do complain about the top traders they copied not performing well. However, this is not the trader’s or the platform’s fault. Trading has always been risky as it is subject to market intuitions and people’s trading behavior, which no one can control.

Conclusion:-

In conclusion, we can say that eToro is one of the leading online cryptocurrency trading platforms in the market. It has a credible reputation as it is backed by a robust team of professionals, and used by traders widely, trading successfully.

The experience of operating eToro is smooth, easy, simple for beginners, and professionals equally. One can use the platform to invest in stocks and crypto assets, as well as trading CFD assets.

Declaimer:

CFDs with this provider are complex instruments of investment and hold a high risk of losing money. 66% of retail investor accounts lose money when trading CFDs with this provider. So it is suggested to trade on eToro only after knowing whether you can afford or bear a high risk of losing your money.

Crypto assets are highly uncertain in terms of their value and are unregulated, one of the reasons why accounts lose money when trading if not aware of the risk very well. Traders do not get the EU’s protection while trading on eToro.