On January 29th, Wednesday, the crypto market witnessed low volatility as the Federal Reserve confirmed maintaining the federal funds rate at 4.25% to 4.50%, aligning with market expectations. Furthermore, the Bitcoin price projected a bullish outlook above $100k, bolstering assets like WIF for a bullish reversal. The dogwifhat price currently wavering at multi-month support amid whale buying indicates a potential for market recovery.

According to Coingecko, the WIF price trades at $1.17, with a market cap of $1.79 billion and a 24-hour trading volume of $1.3 billion.

Key Highlights:

- A rectangle pattern within $4.8 and $1 drives the current consolidation trend in the dogwifhat price.

- The $1 support stands as a key accumulation zone for crypto buyers.

- WIF coin correction countered by whale buying signals ‘buy-the-dip sentiment intact in the market.

dogwifhat Price Sees Renewed Whale Accumulation

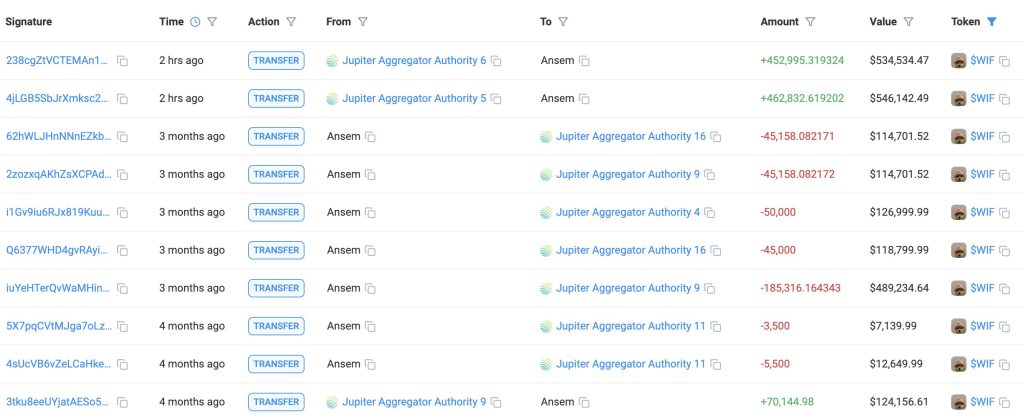

Crypto whale Ansem has reignited interest in dogwfight (WIF) after a three-month hiatus, signaling potential bullish sentiment for the memecoin. According to Lookonchain data, this whale has spent 1.2M USDC stable to buy 915,828 WIF coins at an average of $1.31.

Historically, such renewed whale interest often coincided with a major market bottom and bullish reversal in an asset.

WIF Correction Hints Bottom Formation at $1 Support

Over the past two months, the dogwifhat price has notably underperformed to broader market recovery, which bolsters Bitcoin for a new all-time high. With a series of lower high formations, the dog-themed memecoin plunged from $4.8 to $1.05, accounting for a 78% loss.

An analysis of daily charts shows this downfall as a pullback in long-coming consolidation of nearly a year, resonating within $4.8 and $1 psychological levels. The coin price rebounded twice from both levels indicating the credibility of this rectangle pattern to influence price movement.

With an intraday gain of 14.6%, the dogwifhat price sparks another reversal within the consolidation. The previous reversals from this support led to a 350% rally, signaling the potential for a similar move this time.

On the contrary, if sellers breach the $1 bottom support, the bullish thesis will be invalidated.