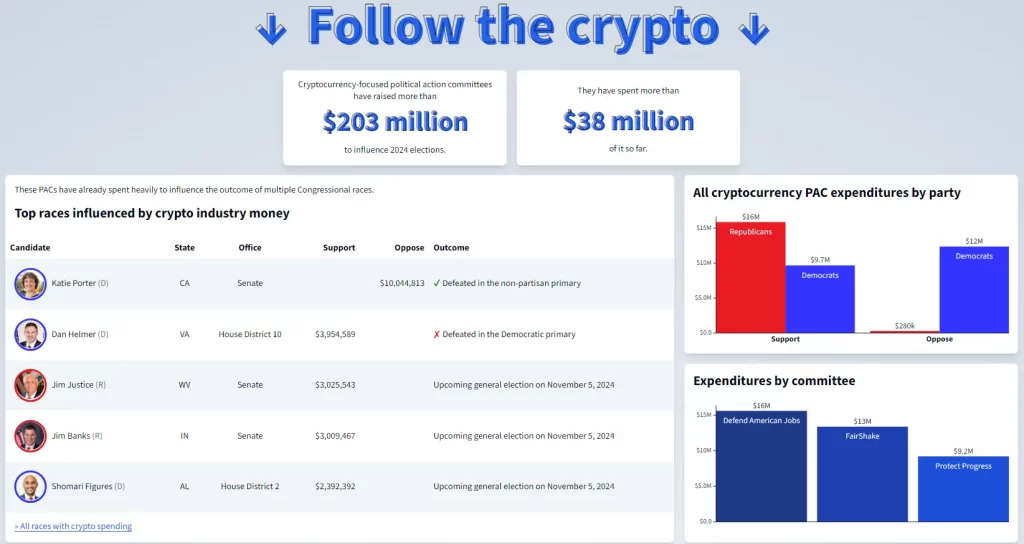

Cryptocurrency-focused political action committees (PACs) are contributing large sums of money to influence key races across the country as the 2024 US Presidential election nears. These PACs have raised over $203 million and then spent more than $38 million – the funds are being used as leverage in American politics. The massive financial commitment highlights the crypto industry’s increasing willingness to attempt to influence policy and regulation through political donations. The sector is flexing its political muscle, as this war chest has not been accrued for no reason. Those funds are injected where they matter most: in favor of or against incumbents and challengers, depending on their position in the industry.

Top races influenced by crypto money

In 2021, expenditures reached $38 million, during which considerable money was allocated to influence favorable policies and legislation within the US for cryptocurrency. Cryptocurrency PACs have poured cash into many high-profile races in the 2020 election cycle. Katie Porter, running for Senate in California, was also backed to more than $10 million. This support, however, failed to keep her from being defeated in the nonpartisan primary.

Also, Dan Helmer outspent his opponent in the Democratic primary for a House seat from Virginia’s 10th District by about $1.5 to one ($4 million v. Crypto PACs are also moving large amounts of money in upcoming elections (in races like the West Virginia gubernatorial campaign for Jim Justice, and a US House primary featuring Rep. Jim Banks), demonstrating an effort to wage both offensive campaigns for friendly candidates as well as defensive efforts against regulatory opponents at every level of government – from dogcatcher on up through any federal office one can name.

Spending patterns

Cryptocurrency PAC’s spending patterns also reveal a more subtle vector of political influence. Republicans have received roughly $16 million in support, compared with the nearly $9.7 million Democrats had at their disposal and spent fighting against several of them. On the other hand, opposition spending paints a different picture, with $280 per candidate opposing Republicans vs. $12 million suppressing Democrats (support/oppose ratio of 42:1). It implies an attempt to strengthen allies and batter opponents on all political spectrum simultaneously.

Political action committees surrounding cryptocurrency are amassing millions through lobbying efforts to defend industry interests against harsh laws. The highest-spending committees are Defend American Jobs ($16 million), FairShake for a Better America (nearly $13 million), and Protect Progress ($over 9.2 million). Industry defense committees have a vital role to play in defending the industry.

Coinbase, which had a hand in the proposal for FairShake, donated $25 million to them only days after Biden vetoed H.J.Res. 109 bill (the crypto custody bill). Ripple and venture capital firm a16z kicked off FairShake’s mega-donor spending spree, each chipping in $25 million on June 4th, according to reporting by CoinDesk, which puts the company at approximately $161 million for this year’s federal elections.

Other notable contributors to FairShake are the Winklevoss twins, Jump Crypto—a digital asset fund under trading giant Susquehanna International Group—and Union Square Ventures. Public Citizen reported that super PACs connected to digital assets, including FairShake, have the third-most raise among all super PACS in anticipation of the 2024 election, affecting crypto political influence.

Crypto is here to stay!

Donating cryptocurrency in political donations is becoming increasingly mainstream, and there have been significant investments in specific candidates over the last few months. In House District 8 in Arizona, for example, $12,349 was spent supporting Blake Masters propping these candidates up) and $11,123 to oppose Jamaal Bowman. High-profile examples demonstrate this trend, including Trump’s election campaign accepting donations in Bitcoin Lightning and the Biden administration looking at crypto contributions. These latest moves demonstrate the strategic allocation of resources to sway contests with significant crypto stakes.

US politics has increasingly become a focal point of cryptocurrency, as pro-crypto candidates need support from crypto-focused political action committees (PACs) to challenge the many opponents within this industry. Then we see that Coinbase, The Winklevoss twins, Jump Crypto, and Union Square Ventures have had a significant investment input in their PACs ( Political Action Committees), which are high contributors to help battle regulatory challenges. While President Biden might have vetoed the crypto custodian bill, these captains of industry will carry on in their quest for an advantageous legislative environment for innovation and market growth.

As the 2024 election cycle ramps up, expect that influence to extend—a representation of a broader politicized use case for cryptocurrency in mainstream politics. Not only can cryptocurrency be a legitimate financial instrument, but to thrive, it needs the proper laws, and in America, we need crypto-friendly legislation; otherwise, we risk maintaining our obstacle state competitiveness edge when it comes to innovation on digital currency.