During Thursday’s U.S. market session, the crypto market witnessed a slowdown in its correction momentum as Bitcoin holds above $82,000. BTC’s neutral candle formation has bolstered several altcoins, including LINK, to seek bottom support. The latest onchain data backs the reversal potential as Chainlink price holds steady above a key support zone, backing a substantial supply of LINK token volume.

Key Highlights:

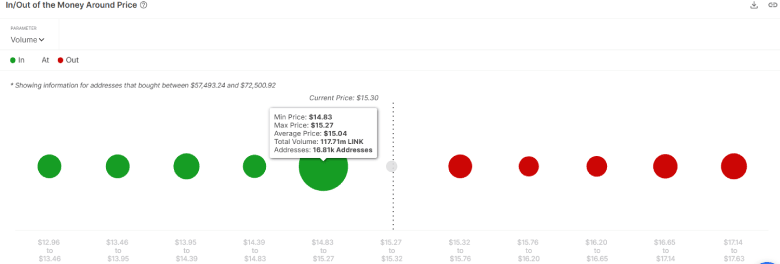

- The $15 level, defended by the 117 Million token supply and bullish pattern support, creates a key reversal zone for buyers.

- Since mid-December 2024, the Chainlink price has shown a steady downtrend resonating within a falling channel pattern.

- A death crossover between the 50-and-200-day exponential moving average could delay the recovery opportunity in LINK.

Chainlink Price Faces Major Resistance Amid Rising Exchange Inflows

This week, the cryptocurrency market witnessed a massive sell-off, which plunged the pioneer digital asset, Bitcoin, below a three-month low of $82,000. Amid this correction trend, the Chainlink price showed firm resilience as it defended the $15 psychological level, evidenced by the long-tail rejection candle.

According to Chainlink’s In/Out of the Money metric, $15 support holds a massive 117.71 Million LINK token support by 16.81 addresses. Analysts often view such supply clusters as potential support zones. If prices continue to hover near these levels without significant sell-offs, it could reinforce bullish sentiment.

Conversely, should broader macro pressures intensify, the LINK price could breach the $15 support and trigger massive liquidation of long position holders, further accelerating the selling pressure.

Chainlink Price Eyes Major Reversal Within Channel Pattern

Along with the $15 support, the Chainlink price seeks support from the bottom trendline of a falling channel pattern. In the daily chart, the chart setup displays two downsloping trendlines which act as dynamic support and resistance.

Historical data shows a reversal from the bottom support has bolstered the LINK price with a 38-58% rally to challenge the overhead trendline. If the pattern holds, the buyers should breach the channel pattern resistance as a signal to end the current correction trend.

The post-breakout rally could surpass overhead resistance of $27.3, followed by $30.

Also Read: BlackRock’s $500M Bitcoin & Ether Dump Stirs the Market, What’s Happening?