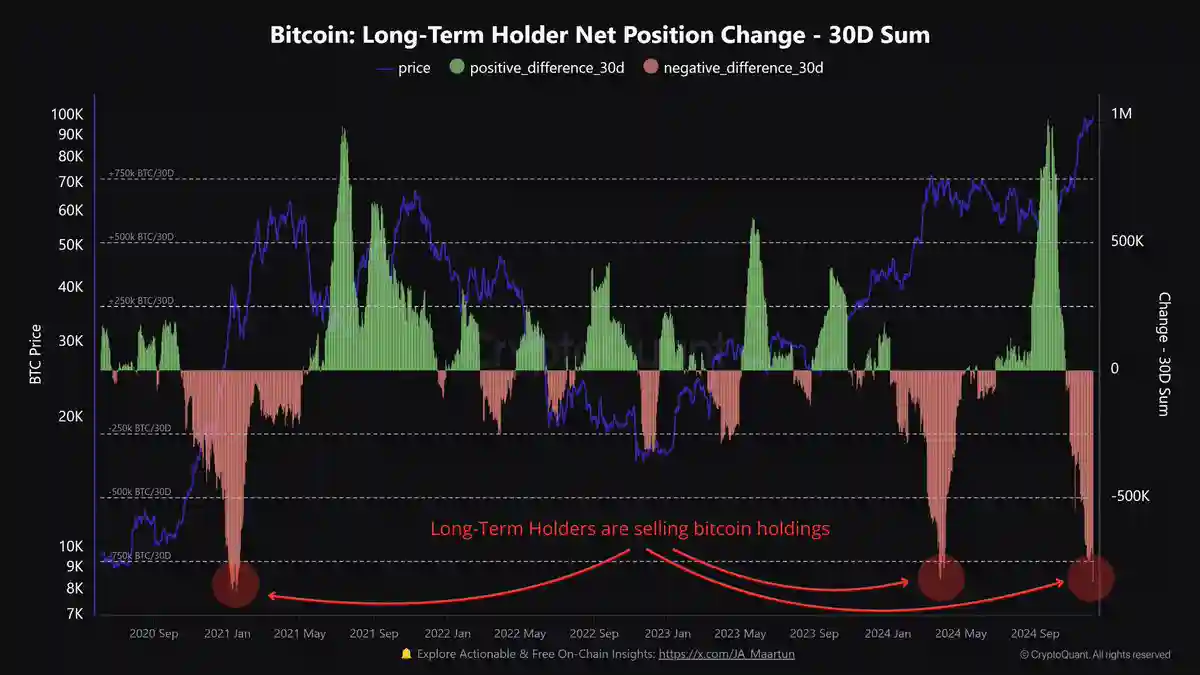

The last few weeks witnessed a huge surge for Bitcoin, as a result of which Bitcoiners have sold around 827,783 BTC worth over $82 billion in the last 30 days. Bitcoin is now below $100K.

🚨Long-Term Holders sold 827,783 BTC in 30 days.

This is one of the bearish on-chain signals behind this BOLT statement.

A thread on more key signals behind this claim📉👇 https://t.co/C2M9CHM83c pic.twitter.com/NgIBf8i3Vm

— Maartunn (@JA_Maartun) December 8, 2024

Bitcoiner sold $82 billion worth of Bitcoin

CryptoQuant analyst Maartunn posted on X, stating that since November 8th, Bitcoin long-term holders (wallets holding Bitcoin for at least 155 days) have sold 827,783 BTC, worth approximately $82.59 billion.

Maartunn highlighted that during the same period, MicroStrategy purchased about 149,800 BTC, and the inflow of Bitcoin into spot Bitcoin ETFs was 84,193 BTC. However, these amounts only represent 30% of the amount sold by long-term holders.

According to CryptoQuant’s retail demand 30-day change chart, Maartunn stated that even while facing strong selling pressure from long-term holders, Bitcoin remains strong as retail demand has also reached an “annual high.”

Maartunn also noted that the seller risk ratio and net taker amount may indicate that Bitcoin has “potentially reached a peak.”

Bitcoin Market Trends

The bullish run and Bitcoin’s new ATH were marred by selling pressure from crypto investors. As a result, a slight dip did not come off as surprising.

At the time of writing, Bitcoin is trading at $99,952, after a short surge of 0.2% in the past day. Its 24-hour trading volume surged by a remarkable 51.28% to $58.58 billion.

The market cap of this seventh-largest valuable asset, which was slightly over $2 trillion on Dec 5, has decreased by 0.09% to $1.96 trillion.

One of the primary factors behind this dip is selling pressure. The Relative Strength Index (RSI 14) stands at 62, indicating a ‘Neutral’ trend. Meanwhile, the Simple Moving Average (SMA 10) is at 98,142, signaling a ‘Buy’ action.

These technical indicators present an optimistic yet mixed outlook. This combination shows stability with the possibility of sustained bullish action and ‘no position correction’ unless external factors disrupt the market.

Also Read: Bitcoin Price Prediction for 2024, 2025 – 2050