Tron (TRX) is currently priced at $0.1597 and is following a rising trend channel for the medium to long term. This trend reflects the increasing optimism among investors and suggests that TRX could see further price hikes.

For now, Tron has a support level of around 0.14, which serves as a buffer against potential negative market movements, reassuring investors that transperformance will remain relatively stable. As long as Tron can hold the support level, the token is expected to maintain a positive momentum.

Bullish Momentum Pick-Up

Technical indicators provide further support for the optimistic Tron price prediction. However, there was a short-term crossover between the 5-day and 20-day moving averages, which hinted at a slight bearish trend that has died down recently. In the medium-term (20 & 50 DMA) and the long-term (50 & 200 DMA), crossovers indicate a bullish outlook for the token. These indicators signal that while short-term price dips can be seen in the market, the overall direction of the trend seems to be upward. As a favorable upward trend commences, Tron can provide huge returns to investors. However, investors would need to keep an eye out for support levels and short-term fluctuations in price.

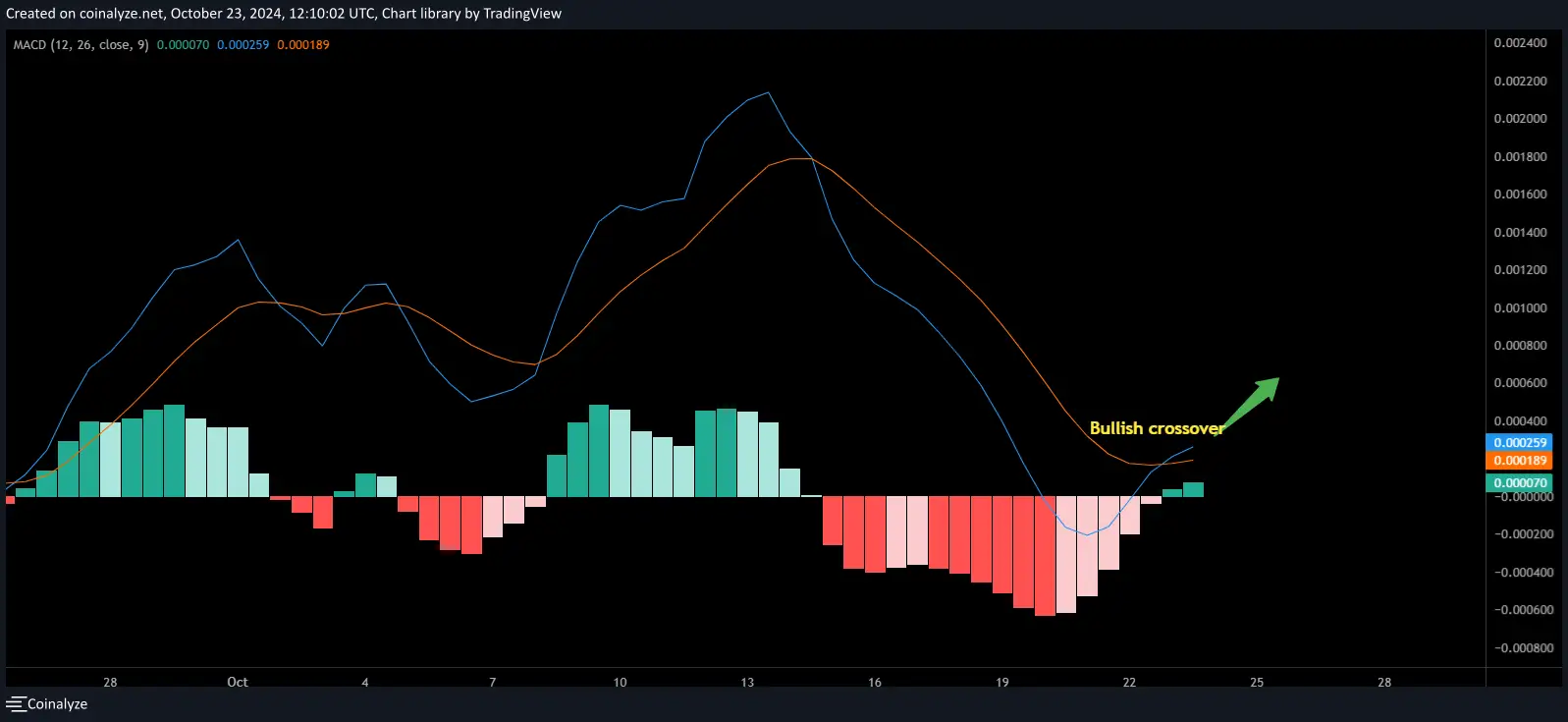

Another technical parameter, i.e, the MACD chart, also confirms the bullish outlook for Tron – With the MACD line crossing over the signal line, a momentum shift can be observed, suggesting the possibility of an upcoming bull run reinstating the previously observed positive sentiment around Tron’s rising trend line. It looks like there are positive technical indicators that suggest the upward trend is likely to keep going as the histograms are starting to show green, which further indicates that bullish momentum is gradually picking up. With no major resistance levels noted on the MACD chart, more price rises seem probable, indicating that the bullish trend is likely to continue unless there is a major market sentiment shift.

If the bull run scene in the crossover can hold itself, Tron can reach as high as $0.20 in the medium term and $0.30 in the long term, depending on the market conditions.