Ethereum, the world’s second-largest cryptocurrency, has just broken into a bull run amid a Uptober market. Ether, the native token of Ethereum, is currently priced at $2,489.62, up from a loss of almost 4% in the last seven days. While many investors were not sure whether the crypto market would be able to keep up October gains, the global liquidations of the crypto hit more than $111 million in the last 24 hours. Given the faith investors are putting even at the fact of the Israel-Iran conflict and other geopolitical tensions, it has kept the Uptober trend running.

What the Experts Are Saying

#Ethereum will devastate the bears like you’ve never seen before. Bookmark this post and share if you agree 🚀 pic.twitter.com/SSq253U81Q

— SEE WOOD (@seewood16) September 30, 2024

Expert analysts predict that investors will be bullish on Ethereum, even as the long-time holder count has decreased. Especially now that Ethereum has broken its weekly support line, more bullish sentiments are taking over the market.

Ethereum’s Road to $3K

For Ethereum, in the last 12 hours, liquidity has risen, though more investors have been going short than long. In the last hour, however, the liquidation count has remained relatively constant. At the same time, there is a significant reduction in Ethereum being sold as more bars turn green, with more people buying the asset. Amid all the spikes and any short dips in liquidity, however, Ethereum’s price has held itself high and stable without any notable fluctuations.

What is Next?

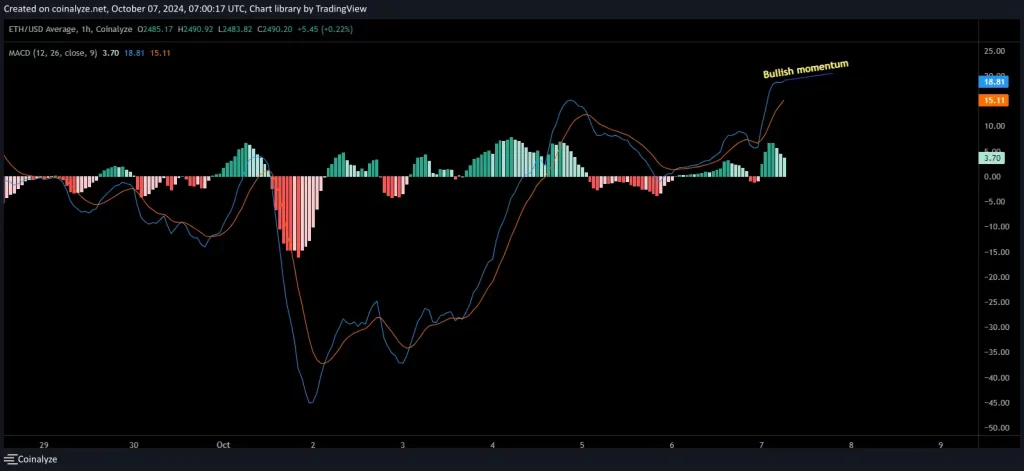

Ethereum is now on its Road to $3000 as the bullish sentiments are building. For the last five hours, Ethereum’s new support level has been $2417, and the new resistance level has been $2510, indicating that the asset is reaching a psychological price level of $3k. If the bullish moment persists, then Ethereum’s price will surely get the new mark – $3000- and might steer even higher. To attest to the prediction, we can also look into the MACD analysis. Read more on the ETH price forecast.

In the MACD chart, the blue line, a.k.a the MACD line, has been experiencing a bullish crossover, keeping the orange, a.k.a signal line below. Additionally, the histograms are turning green, suggesting a solid bullish momentum as buyers are currently in control. Given the liquidity chart and the MACD analysis, Ethereum is likely to make the $3K mark.

Ethereum may test the new resistance level at the $3500 mark if the asset can cross the $3000 mark. While hitting its previous all-time high at $4,891.70 is a pie in the sky, investors can keep their eye on the current price -$3000.