On 22nd August, the U.S. Bitcoin ETF saw a total net positive inflow of $64.8 million, with BlackRock’s IBIT, yet again, taking the lead with a $75.5 million inflow. For the Ethereum ETF, the total net positive inflow closed in on $0.874 million, with a total net outflow rounding up to $19.8 million.

With a six-day consecutive inflow streak, BlackRock comes in first place, followed by Fidelity’s ETF FBTC, which eyed an inflow of $9.23 million. As usual, Grayscale’s ETF GBTC got the last place with an outflow of $28.36 million. This brings the total net asset value of Bitcoin ETFs to $55.13 million.

Even though Grayscale’s outflow was massive, the asset management titan still leads the Ethereum ETF segment. By October of this year, Grayscale’s ETFs are set to account for 50% of the market. As of 22nd August, the total Ethereum ETF asset across all asset management firms was $7.27 billion.

Market Capitalization Drops For Ether and Bitcoin

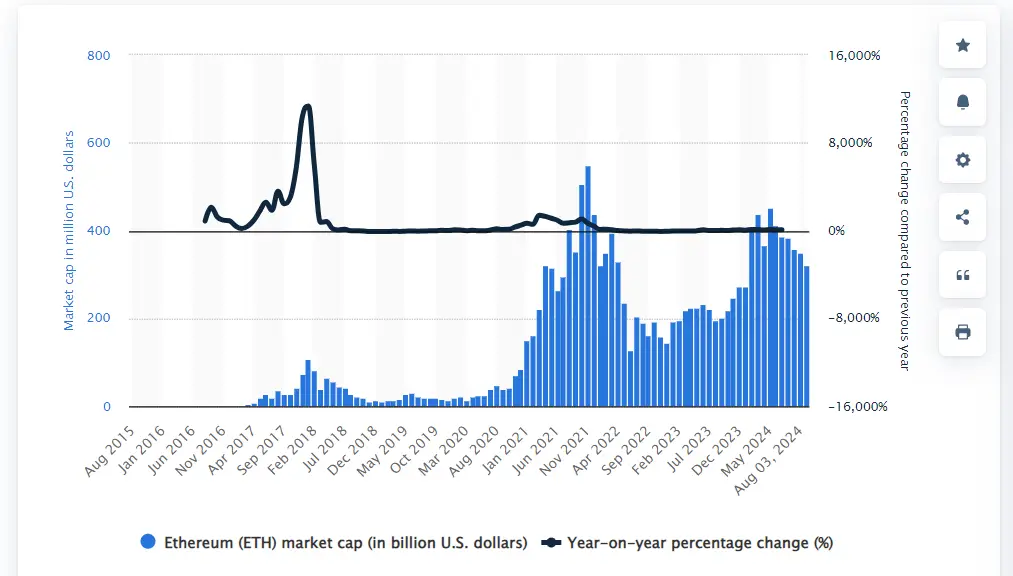

While ETFs had been expected to help boost market adoption for Bitcoin and Ethereum, the market cap for both crypto assets has reduced exponentially. Forbes data reveals that Bitcoin’s market cap was $1.44 trillion in March of this year, while as of August, the number has plummeted to $1.21 trillion. Ethereum had a market capitalization of USD 438 billion, which has now been reduced to USD 321 billion, as per Statista. This drop suggests that a number of traders are cashing out of the markets for profits, anticipating an impending correction. This propels us to question if the market is shifting focus from crypto to crypto-backed ETFs.