In the first week of August, Bitcoin noted substantial shifts as it transitioned from a buy phase to a sell phase. On August 7th, the price of Bitcoin was $56,040.63. This change was particularly notable among wallets and long-term holders (LTHs). During the sell-side pressure period, many retail investors offloaded their holdings to maximize profit margins. However, recent on-chain data indicates a shift in this trend.

Trend Reversal

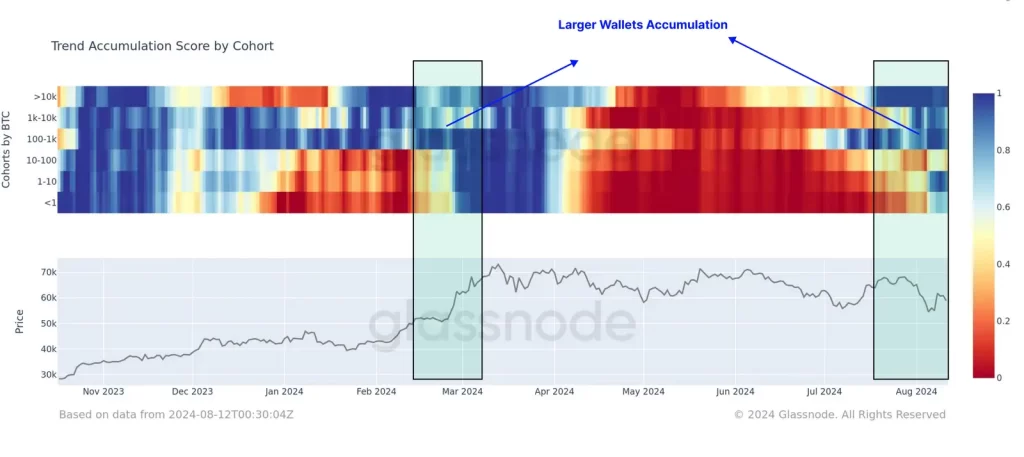

Large holder wallets, often associated with investors or whales, are now showing signs of re-entering the buying phase. This shift indicates that confidence in Bitcoin is being restored. A week later, on August 14th, Bitcoin was priced at $60,945 at press time.

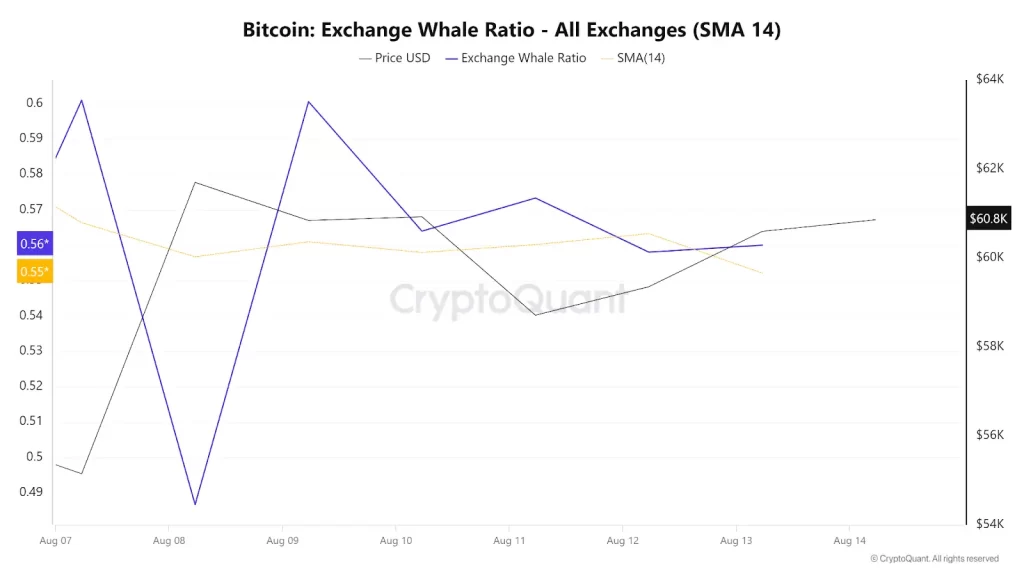

Starting August 11th, the Whale Ratio steadied around 0.55, tracking its 14-day SMA. This points to whales maintaining a steady level of activity. As this happened, Bitcoin’s price began to bounce back, climbing from about $58K to $60.8K by August 14th. The fact that things leveled out suggests whales didn’t go on a buying or selling spree, which helped keep the market on an even keel. This might mean big players feel good about the market and are waiting for better conditions before making big moves. For people looking to invest in how whales are acting right now, it could mean the market’s in a calm spot with room to grow.

Recent data from Glassnode also indicates that big wallets linked to institutional investors or groups managing Bitcoin ETFs have begun to boost their Bitcoin holdings. For example, long-term holders (LTHs) who earlier sold off large amounts of Bitcoin during the ATH now embrace a HODLing (Hold On for Dear Life) approach.

Further, in the past three months, LTHs have added more than 374,000 BTC to their status. This trend suggests these holders believe in Bitcoin’s long-term worth, and a new weekly all-time high could be on the horizon, as per Bitcoin price prediction analysis.

HODLing

The Long-Term Holder Sell-Side Risk Ratio also currently stays low compared to past market cycles. This ratio measures the realized profit and loss investors lock in relative to the asset’s size. The current low value shows that LTHs aren’t rushing to take profits, suggesting they’re waiting for higher prices before they start distributing more.

This hesitation to sell at current prices backs up the idea that whales think the market will go up and are getting ready for it.

For everyday investors, this behavior sends a strong message! Following what whales do – since they often know more and have more resources – could be a smart move right now. The on-chain data points to whales betting on a better future for Bitcoin, and their buying phase might lead to the next big price jump.