Bitcoin managed to saunter above $60,000 for the first time since it broke off its last high at $58k. This is a major milestone representing Bitcoin’s continued resilience and adoption in traditional finance. That growth is a testament to the fundamentals, which have not only held firm with regard to Bitcoin’s price resilience but also shown how much impact institutional investors and long-term holders continue having on supporting its value by pushing demand higher.

Analyzing the Market Dynamics

A few days ago, cryptocurrency analyst Ali Martinez also observed a rising wedge pattern, which usually signals an incoming breakdown, and predicted Bitcoin’s decline. The evaluation suggested a retest of $51,000 if Bitcoin breaches a critical support level of about $53,500.

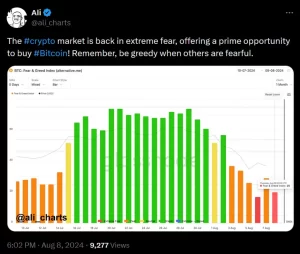

While August 8th brought uncertainty to the cryptocurrency market, some traders remained steadfast in their support for Bitcoin. The price teetered on the edge of a substantial decline as fear took hold, though committed investors continued purchasing at a renewed pace. Their boldness in the face of doubt helped spur an unexpected rally, driving the primary digital asset back above $61,000. Yet confusion persists: with benchmarks like the fear and greed index now hovering near 48, it remains unclear whether this latest rebound will sustain or succumb to downward pressures. Determining which forces may dominate in the days ahead could help traders protect their positions from potentially sharp swings in either direction.

Whales in the Mix

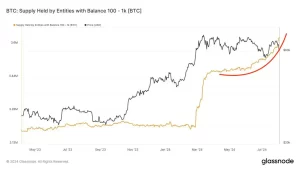

Institutional investors and hodlers (whales), among others, took Bitcoin higher — well above the 60k mark. As reported, some of the largest asset managers — such as BlackRock, Fidelity, and Grayscale- have been buying Bitcoin on every dip, which is a demonstration that they believe in the long-term value of this digital gold.

They have accumulated billions of dollars worth of Bitcoin in his company — signaling utmost confidence about the future. Furthermore, the event that was held at Bitcoin Park highlighted and emphasized the market buying of institutions such as BlackRock and Grayscale, amongst others, not being scared to add to their cumulative supply throughout these recent dips.

Can Bitcoin hold its ground at 60K?

The technical analysis, the institutional backing, and what we were seeing on-chain made Bitcoin’s rise to $60K nearly inevitable. This fits nicely with the big financial institutions’ adoption and accumulation over recent months. If the overall trend remains intact, this could be a new baseline for Bitcoin. With whales choosing to hold on to their Bitcoin, a new ATH might be in the picture.

However, as per Bitcoin predictions, short-term price corrections are expected. The next resistance level could go up to 65k. As we cross this latest milestone, it is imperative to see how the market behaves further—whether it will go above those levels or face a retracement. Despite an intact value proposition, Bitcoin must prove whether this milestone can act as a solid base for further growth, or we will see the market test lower support levels before another bull run.