With the inflows amounting to a strong $441 million, investor interest has recently been on the rise, as exhibited by CoinShares data. This indicates that investors are keen on investing in digital assets.

The rise in popularity is encouraging, given the market turmoil started by Mt. Gox and selling pressure from the German Government. These events appear to be seen as buying opportunities by investors, a positive signal in favor of digital assets.

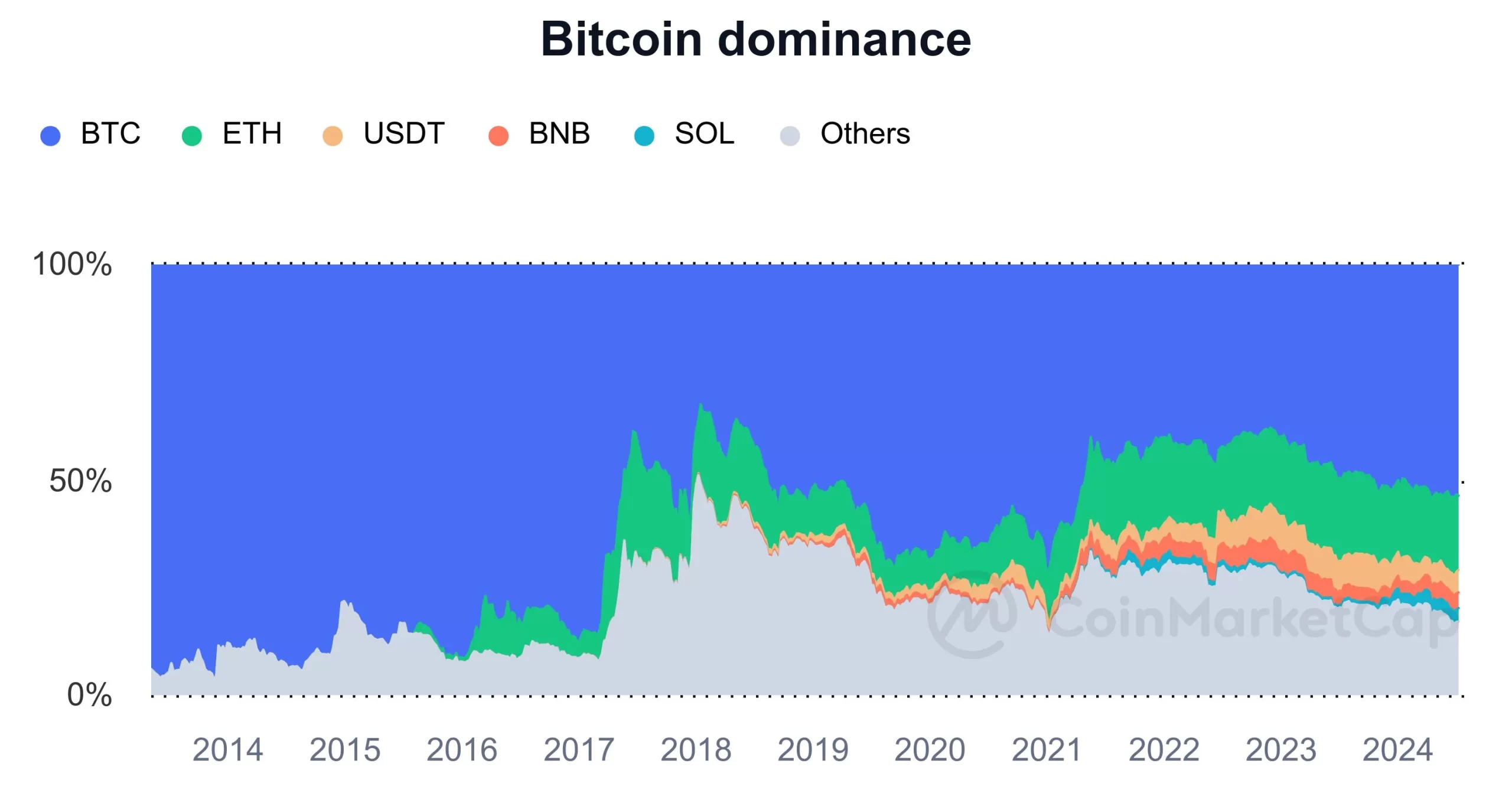

Bitcoin continues to dominate

Bitcoin is still the king of crypto, attracting most of the new investment ($398 million out of $441 million). However, its dominance is not as usual. This suggests investors are diversifying their portfolios by purchasing altcoins, which is a bit surprising considering the recent focus on Bitcoin by big investors.

Altcoins come the forefront

Solana was one of the top altcoin inflow players last week, with $16 million hitting its market. This takes its year-to-date (YTD) inflows to a whopping $57 million, also making it the highest-flowing altcoin this year. Ethereum, which continued to remain under-owned, finally enjoyed some positive sentiment as over $10 million came back in. But it is still the only Exchange-Traded Product (ETP) with a net outflow YTD.

The detailed data on inflows, marked by region, shows that the destination country for investments was $384m, led by the U.S. Hong Kong, Switzerland, and Canada also saw some significant opportunistic buying, raking in $32 million with inflows of $24 million and a modest (given the size) $12 million, respectively. An odd market view stood out in Germany, with $23 million in outflows.

Blockchain equities take a blow

While digital asset investment products have enjoyed a positive underlying tone, the happy tailwind has not powered into blockchain equities. Last week, an extra $8m of outflows was recorded from blockchain equities, bringing 2024 YTD outflows to a stark $556 million.

The contrast emphasizes an air of caution or bearish position among investors regarding blockchain equities compared to the broader digital asset markets, which have displayed more bullishness than ever. The data indicates major bullishness towards Bitcoin and some altcoins, such as Solana. Nonetheless, blockchain equities have not seen similar investor optimism, with cash being pulled out continually.